US Airways 2005 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2005 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

America West Airlines, Inc.

Notes to Consolidated Financial Statements — (Continued)

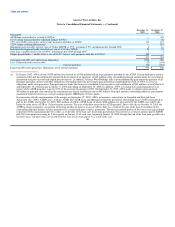

option plans. US Airways outstanding stock options were cancelled as part of the plan of reorganization. Accordingly, as of January 1, 2006, only unvested

director stock options, employee stock options, and stock appreciation rights granted subsequent to the merger are subject to the transition provisions of

SFAS 123R.

As of January 1, 2006, approximately 2,865,925 unvested stock options and stock-based awards with weighted average fair values ranging from $7.94 to

$11.34 are subject to the recognition provisions of SFAS 123R. AWA expects that the impact of adoption of SFAS 123R will be significant to the 2006

results of operations.

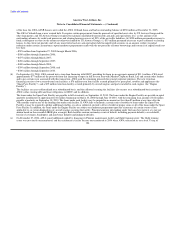

In May 2005, the FASB issued SFAS No 154, "Accounting Changes and Error Corrections — A replacement of APB Opinion No. 20 and FASB

Statement No. 3" ("SFAS 154"). SFAS 154 applies to all voluntary changes in accounting principle, and changes the requirements for accounting for and

reporting of a change in accounting principle. SFAS 154 requires retrospective application to prior periods' financial statements of a voluntary change in

accounting principle unless it is impracticable. APB Opinion 20 previously required that most voluntary changes in accounting principle be recognized by

including in net income of the period of the change the cumulative effect of changing to the new accounting principle. The provisions in SFAS 154 are

effective for accounting changes and correction of errors made in fiscal years beginning after December 15, 2005. The adoption of SFAS 154 is not expected

to have a material effect on the results of operations of AWA.

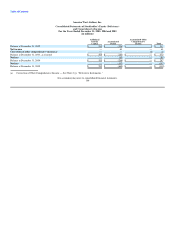

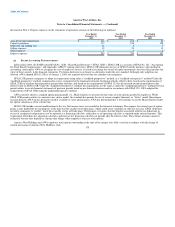

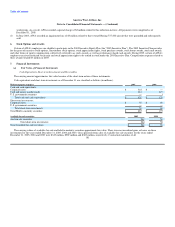

3. Change in Accounting Policy for Maintenance Costs

AWA historically recorded the cost of major scheduled airframe, engine and certain component overhauls as capitalized assets that were subsequently

amortized over the periods benefited (referred to as the deferral method). US Airways Group charges maintenance and repair costs for owned and leased flight

equipment to operating expense as incurred (direct expense method). During the fourth quarter of 2005, AWA changed its accounting policy from the deferral

method to the direct expense method. While the deferral method is permitted under accounting principles generally accepted in the United States of America,

AWA believes that the direct expense method is preferable because the direct expense method is the predominant method used in the airline industry and

because it eliminates significant judgment and estimation inherent under the deferral method.

The effect of this change in accounting for aircraft maintenance and repairs is recorded as a cumulative effect of a change in accounting principle. The

effect of the change in 2005 was to increase net loss by approximately $48 million. The increase in the 2005 net loss of $202 million is the cumulative effect

on retained earnings of the adoption as of January 1, 2005. The cumulative effect of the change in accounting principle is not presented net of tax as any tax

effects resulting from the change have been immediately offset by the recording of a valuation allowance through the same financial statement caption.

The 2005 quarterly financial data presented in Note 18, has been adjusted to reflect the change in accounting policy as if the change occurred on

January 1, 2005. In addition, pro forma quarterly financial data for 2004 has been presented to reflect comparable information as if the newly adopted

accounting policy for maintenance costs had been applied during all periods affected.

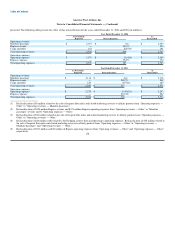

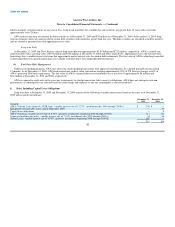

4. Change in Method of Reporting for America West Express Results and Other Reclassifications

Certain prior year amounts have been reclassified to conform with the 2005 presentation. These reclassifications include reclassing: fuel hedging activities

from nonoperating to operating expenses, fuel-related tax expenses from other expenses to aircraft fuel and related taxes expense and the sale of frequent flier

miles and related marketing services to affinity partners from other operating expense to mainline passenger and other revenue. The portion of the affinity

partner revenue related to passenger ticket sales is 176