US Airways 2005 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2005 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

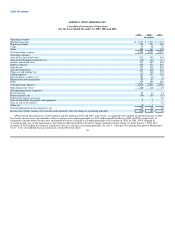

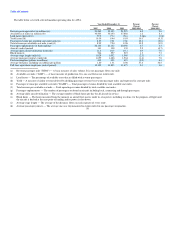

• Aircraft rent expense per ASM increased 6.3% due principally to aircraft mix, as previously owned and leased Boeing 737-200 aircraft were retired or

returned to aircraft lessors and replaced with leased Airbus A320 and A319 aircraft at higher monthly lease rates.

• Aircraft maintenance materials and repair expense per ASM increased 24.5% due principally to the change in AWA's accounting policy for certain

maintenance costs in 2005 discussed above. See note 3, "Change in Accounting Principle for Maintenance Costs," to the consolidated financial

statements in Item 8B of this report.

• Other rent and landing fees per ASM increased 3.8% mainly due to higher landing fees ($4 million) and airport rents ($4 million).

• Selling expenses per ASM increased 4.2% due to higher credit card fee expenses of $8 million and advertising expenses of $2 million.

• Depreciation and amortization expense per ASM decreased 3.6% due principally to decreases in amortization expense related to computer hardware and

software ($3 million) and rotable and repairable spare parts ($3 million) as a result of the 2005 change in accounting policy for certain maintenance

costs discussed above.

• Other operating expenses per ASM increased 2.3% in 2005. Increases in property taxes ($3 million), ground handling services ($2 million), airport

guard services ($2 million) and crew per diem ($2 million) during 2005 were offset in part by lower legal fees ($6 million). The 2005 period included

an $8 million aggregate loss associated with two aircraft sale-leaseback transactions and a $5 million accrual for a retroactive billing by the TSA for

passenger security fees. The 2004 period included a $6 million charge resulting from the settlement of pending litigation and a $5 million loss on the

sale and leaseback of two new aircraft. A $4 million gain resulting from the settlement of a claim in bankruptcy for amounts earned under an executory

contract, a $2 million gain resulting from the settlement of a lawsuit related to certain computer hardware and software that had previously been written

off, a $2 million reduction in bad debt expense due to a recovery of a previously reserved debt and a $1 million volume incentive earned due to certain

affinity card sales levels meeting certain contract thresholds in 2004 also contributed to the year-over-year increase.

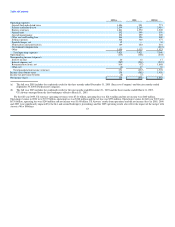

Express expenses increased 45.7% in 2005 to $545 million from $374 million in 2004. Aircraft operating expense for 2005 was $211 million, which

accounted for $56 million of the year-over-year increase in Express operating expenses. Aircraft fuel expense was $182 million in 2005, which accounted for

$80 million of the year-over-year increase.

AWA had net nonoperating expenses of $75 million in 2005 as compared to $69 million in 2004. Interest income increased $11 million to $25 million in

2005 due to higher average cash balances and higher average rates of return on investments. Interest expense increased $8 million or 9.3% to $94 million

primarily due to higher average outstanding debt, due in part to the merger and higher interest rates.

The 2005 period included nonoperating expenses of $8 million related to the write-off of the unamortized value of the ATSB warrants upon their

repurchase in October 2005 and an aggregate $2 million write-off of debt issuance costs associated with the exchange of the 7.25% Senior Exchangeable

Notes due 2023 and retirement of a portion of the loan formerly guaranteed by the ATSB. The 2004 period included a $1 million gain on the disposition of

property and equipment due principally to the sale of two Boeing 737-200 aircraft and a $1 million charge for the write-off of debt issuance costs in

connection with the refinancing of the term loan.

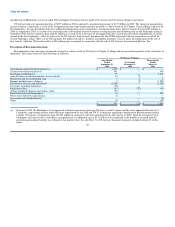

2004 Compared with 2003

Total operating revenues for 2004 were $2.75 billion, an increase of $176 million from 2003. Passenger revenues were $2.20 billion in 2004 compared to

$2.12 billion in 2003. RPM's increased 9.6% as capacity as measured by ASM's increased 8.1%, resulting in a 1.0 point increase in load factor to 77.4%.

RASM 60