US Airways 2005 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2005 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

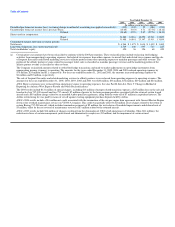

• An $83 million charge for employee severance and benefits. In September 2001, US Airways announced that in connection with its reduced flight

schedule it would terminate or furlough approximately 11,000 employees across all employee groups. Approximately 10,200 of the affected

employees were terminated or furloughed on or prior to January 1, 2002. Substantially all the remaining affected employees were terminated or

furloughed by May 2002. US Airways' headcount reduction was largely accomplished through involuntary terminations/furloughs. In connection

with this headcount reduction, US Airways offered a voluntary leave program to certain employee groups. Voluntary leave program participants

generally received extended benefits (e.g. medical, dental, life insurance) but did not receive any furlough pay benefit. The nine months ended

December 31, 2003 and the year ended December 31, 2002 include $1 million and $3 million, respectively, in reductions to severance pay and

benefit accruals related to the involuntary termination or furlough of certain employees.

• Charges of $4 million and $66 million, respectively, representing the present value of the future minimum lease payments on three B737-200 aircraft

and four F-100 aircraft, respectively, that were permanently removed from service.

• A charge of $13 million representing the unamortized leasehold improvement balance for facilities to be abandoned and aircraft to be parked as of

the facility abandonment date or aircraft park date. In addition, US Airways recognized a pretax charge of $3 million representing the present value

of future noncancelable lease commitments beyond the facility abandonment date.

• A $2 million curtailment charge related to a certain postretirement benefit plan.

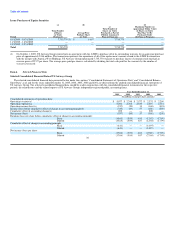

(c) Nonoperating income (expense) for the nine months ended September 30, 2005 and the year ended December 31, 2004 include reorganization items

which amounted to a $636 million net gain and a $32 million expense, respectively. The nine months ended December 31, 2003 include a $30 million

gain on the sale of US Airways' investment in Hotwire, Inc. In connection with US Airways' first bankruptcy, a $1.89 billion gain and charges of

$294 million of reorganization items, net are included for the three months ended March 31, 2003 and the year ended December 31, 2002, respectively.

(d) Includes debt, capital leases and postretirement benefits other than pensions (noncurrent). Also includes liabilities subject to compromise at

December 31, 2004 and December 31, 2002.

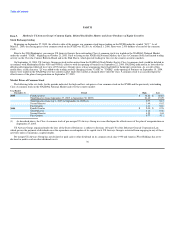

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

Background

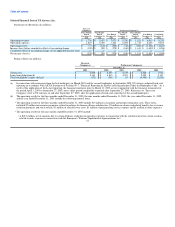

US Airways Group is a holding company whose primary business activity, prior to the merger, was the operation of a major network air carrier through its

ownership of the common stock of US Airways, Piedmont, PSA, Material Services Company and Airways Assurance Limited. US Airways, along with a

network of US Airways Group's regional airline subsidiaries and affiliated carriers flying as US Airways Express, was a hub-and-spoke carrier with a

substantial presence in the Eastern United States and with service to Canada, the Caribbean, Latin America and Europe. US Airways had approximately

42 million passengers boarding its planes in 2005 and, prior to the merger, was the seventh largest U.S. air carrier based on ASMs and RPMs. As of

December 31, 2005, US Airways operated 232 jet aircraft and 18 regional jet aircraft. During 2005, US Airways provided regularly scheduled service or

seasonal service at 91 airports in the continental United States, Canada, the Caribbean, Latin America and Europe. As of December 31, 2005, the US Airways

Express network served 130 airports in the United States, Canada and the Bahamas, including approximately 39 airports also served by US Airways. During

2005, US Airways Express air carriers had approximately 18.7 million passengers boarding their planes, including 1.9 million passengers on US Airways'

MidAtlantic division. In 2005, US Airways and US Airways Express generated passenger revenues of $6.48 billion.

America West Holdings is a holding company whose primary business activity was the operation of a low-cost air carrier through its ownership of AWA.

AWA accounted for most of America West Holdings' revenues and expenses prior to the merger in September 2005. Prior to the merger and based on 2005

43