US Airways 2005 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2005 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

US Airways Group, Inc.

Notes to Consolidated Financial Statements — (Continued)

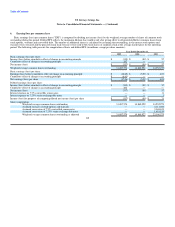

• $450 million through September 2007;

• $400 million through March 2008;

• $350 million through September 2008; and

• $300 million through September 2010.

US Airways was required to pay down the principal of its loan with the first $125 million of net proceeds from specified asset sales identified in

connection with its Chapter 11 proceedings, whether completed before or after emergence. US Airways then retains the next $83 million of net

proceeds from specified assets sales, and must prepay the principal of the loan with 60% of net proceeds in excess of an aggregate of $208 million from

specified asset sales to the ATSB. Any such asset sales proceeds up to $275 million are to be applied to the outstanding principal balance in order of

maturity, and any such asset sales proceeds in excess of $275 million are to be applied to the outstanding principal balance on a pro rata across all

maturities in accordance with the loan's early amortization provisions. As a result, semi-annual payments are now scheduled to begin on September 30,

2007, instead of March 31, 2007, as originally scheduled in the loan agreement. US Airways made prepayments totaling $156 million in connection

with these specified asset sales completed during 2005.

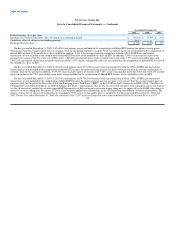

(f) In September 2005, US Airways entered into an agreement to sell and leaseback certain of its commuter slots at Ronald Reagan Washington National

Airport and New York LaGuardia Airport. US Airways continues to hold the right to repurchase the slots anytime after the second anniversary of the

slot sale/leaseback transaction. These transactions were accounted for as secured financings. Installments are due monthly through 2015.

(g) Capital lease obligations consist principally of certain airport maintenance and facility leases which expire in 2018 and 2021.

(h) GE, together with its affiliates, is US Airways Group's largest aircraft creditor, having financed or leased a substantial portion of its aircraft prior to the

most recent Chapter 11 filing. In June 2005, GE purchased the assets securing the GE Credit Facility in a sale-leaseback transaction. The sale proceeds

realized from the sale-leaseback transaction were applied to repay the 2003 GE Liquidity Facility, the mortgage financing associated with the CRJ

aircraft and a portion of the 2001 GE Credit Facility. The balance of the GECC Credit Facility was amended to allow additional borrowings of

$21 million in July 2005, which resulted in a total principal balance outstanding thereunder of $28 million. The operating leases are cross-defaulted

with all other GE obligations, other than excepted obligations, and are subject to agreed upon return conditions.

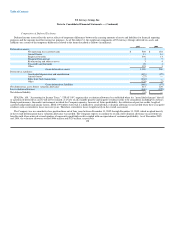

(i) On September 30, 2005, US Airways Group issued $144 million aggregate principal amount of 7% Senior Convertible Notes due 2020 (the "7% Senior

Convertible Notes") for proceeds, net of expenses, of approximately $139 million. The 7% Senior Convertible Notes are US Airways Group's senior

unsecured obligations and rank equally in right of payment to its other senior unsecured and unsubordinated indebtedness and are effectively

subordinated to its secured indebtedness to the extent of the value of assets securing such indebtedness. The 7% Senior Convertible Notes are fully and

unconditionally guaranteed, jointly and severally and on a senior unsecured basis, by US Airways Group's two major operating subsidiaries,

US Airways and AWA. The guarantees are the guarantors' unsecured obligations and rank equally in right of payment to the other senior unsecured and

unsubordinated indebtedness of the guarantors and are effectively subordinated to the guarantors' secured indebtedness to the extent of the value of

assets securing such indebtedness.

The 7% Senior Convertible Notes bear interest at the rate of 7% per year payable in cash semiannually in arrears on March 30 and September 30 of

each year, beginning March 30, 2006. The 7% Senior Convertible Notes mature on September 30, 2020.

128