US Airways 2005 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2005 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

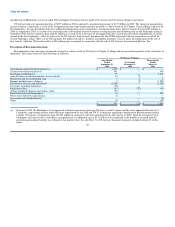

was accrued at December 31, 2003. In addition, the 2004 period was impacted by a decrease in accrued compensation and vacation benefits primarily due to

the payment in March 2004 of the Company's obligation for employee performance bonuses and award pay ($20 million), which was accrued at December 31,

2003.

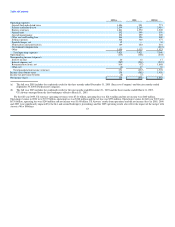

Net cash provided by investing activities was $399 million and $16 million in 2005 and 2004, respectively. Principal investing activities in 2005 included

the merger transaction, which included $258 million of net cash acquired. Other investing activities in 2005 included net purchases of short-term investments

totaling $295 million and purchases of property and equipment totaling $44 million. The Company also received proceeds of $592 million from flight

equipment asset sales, sale and leaseback transactions and sales of other property and equipment. Restricted cash increased by $112 million in 2005 primarily

due to an increase in cash reserves required under an agreement for processing AWA's Visa and MasterCard credit card transactions. The 2004 period

included purchases of property and equipment totaling $219 million, of which $139 million was expenditures for capitalized maintenance. The 2004 period

also included net sales of short-term investments and investments in debt securities totaling $205 million.

Net cash provided by (used in) financing activities was $531 million and ($41) million in 2005 and 2004, respectively. Principal financing activities in

2005 included the issuance of US Airways Group common stock for $732 million in cash, and proceeds from the issuance of debt totaling $655 million,

which included a $325 million loan from an affinity credit card partner, $186 million from the Airbus loans and $144 million from the issuance of the

7% senior convertible notes. The debt repayments totaled $741 million in 2005 and included a $433 million reduction in aircraft-related debt as a result of

flight equipment asset sales and sale and leaseback transactions, the GE debt repayment of $125 million, approximately $125 million in ATSB loan

repayments, and the redemption of AWA's 10.75% senior unsecured notes totaling $40 million. In 2004 net cash used in financing activities was $41 million

for the Company, consisting principally of $176 million of debt repayments, including principal repayments of $86 million for the government guaranteed

loan. In addition, AWA entered into a term loan financing with GECC resulting in proceeds of $111 million, approximately $77 million of which was used to

pay off the balance of the term loan with Mizuho Corporate Bank, Ltd. and certain other lenders. The 2004 period also includes $31 million of proceeds from

the issuance of senior secured discount notes, secured by AWA's leasehold interest in its Phoenix maintenance facility and flight training center.

Capital expenditures for 2005 were $44 million for US Airways Group. This compares to $219 million of capital expenditures for 2004, which includes

capital expenditures for capitalized maintenance of approximately $139 million. The 2005 period does not include capital expenditures for capitalized

maintenance, as AWA changed its accounting policy from the deferral method to the direct expense method effective January 1, 2005. See note 4, "Change in

Accounting Policy for Maintenance Costs," in the notes to consolidated financial statements in Item 8A of this report.

AWA

At December 31, 2005, AWA's total cash, cash equivalents, short-term investments, and restricted cash balance was $1.18 billion, of which $951 million

was unrestricted. Net cash provided by operating activities for AWA was $974 million and $20 million in 2005 and 2004, respectively. The year-over-year

increase in net cash provided by operating activities of $954 million was primarily due to an increase in payable to affiliate as AWA received proceeds on

behalf of US Airways Group from the merger-related financing transactions including the initial equity investments, the public stock offering, the exercise of

options by equity investors, the issuance of 7% senior convertible notes and the Airbus loans, net of cash retained by US Airways Group.

Net cash provided by (used in) investing activities was ($283) million and $16 million in 2005 and 2004, respectively. Principal investing activities during

2005 included net purchases of short-term investments totaling $163 million, purchases of property and equipment totaling $37 million and $72 million of net

proceeds from the sale and leaseback of certain owned aircraft. Restricted cash

71