US Airways 2005 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2005 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

$500,000 to resolve an outstanding grievance over pay credits for pilots assigned by US Airways to travel to and from certain duty assignments.

While a significant amount of the Debtors' liabilities were extinguished as a result of the discharge granted upon confirmation of the plan of

reorganization, not all of the Debtors' liabilities were subject to discharge. The types of obligations that the Debtors remain responsible for include those

relating to their secured financings, aircraft financings, certain environmental liabilities, the continuing obligations arising under contracts and leases assumed

by the Debtors and certain grievances with our labor unions, as well as allowed administrative claims. Allowed administrative claims consist primarily of the

costs and expenses of administration of the Chapter 11 cases, including the costs of operating the Debtors' businesses since filing for bankruptcy. The Debtors

received a large number of timely filed administrative claims, as well as additional claims that were late filed without permission of the Bankruptcy Court.

Included in these claims, however, are claims for amounts arising in the ordinary course that have either already been paid, or that are included in the Debtors'

business plan and are expected to be paid in the ordinary course. Also included are claims that are duplicative, claims for which the Debtors believe there is no

legal merit for a claim of any status, and claims that the Debtors believe may be valid as unsecured claims but are not entitled to administrative claims status.

Accordingly, the Debtors believe that only a very small portion of the claims filed in response to the bar dates for non-ordinary course administrative expense

claims will actually be allowed in amounts exceeding the ordinary course expenditures already contained in the Debtors' business plan. However, there can be

no assurances that the aggregate amount of the claims ultimately allowed will not be material. To the extent any of these claims are allowed, they will

generally be satisfied in full.

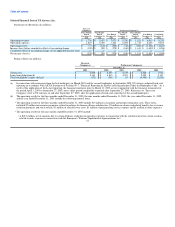

2005 Overview

Merger and Related Synergies

We believe that US Airways Group has one of the most competitive cost structures in the airline industry due to cost cutting measures initiated by both

companies over the last three years. US Airways Group's restructuring activities in its Chapter 11 bankruptcy proceedings specifically targeted cost reductions

in four main areas. First, it achieved important reductions in labor, pension and benefit costs resulting in ratified collective bargaining agreements,

representing over $2 billion of annual cost savings. Second, it put restructuring initiatives in place to reduce overhead including reducing management payroll,

and re-vamped its schedule to improve aircraft utilization. Third, it renegotiated various contractual obligations resulting in lower costs, including those

related to aircraft, real estate and suppliers, and lowered catering costs. Lastly, US Airways Group rationalized its fleet through the elimination of older, less

efficient aircraft, the introduction of large regional jet aircraft with low trip costs to better match capacity with demand, and the reduction of the number of

mainline aircraft types it operates in order to lower maintenance, inventory and pilot training costs.

Separately, America West Holdings has also been able to greatly reduce its operating expenses as a percentage of revenues since 2002. America West

Holdings instituted programs to reduce management payroll, clerical payroll, travel agency based commissions, incentive programs and override

commissions. It reduced capital expenditures and discretionary expenses, and lowered catering costs. Other initiatives include increasing point-to-point flying

at minimal additional costs using aircraft that would otherwise be parked at a gate, which increases daily utilization of aircraft.

In addition to cost saving initiatives already undertaken at the individual companies, we believe the combination of America West Holdings and

US Airways Group may result in significant annual revenue and cost synergies of approximately $600 million that would have been unachievable without the

merger. These synergies derive from three principal sources. US Airways Group has reduced its existing fleet so that the fleet of the combined company suits

the expected network. US Airways Group will be able to schedule the combined fleet to better match aircraft size with consumer demand. By scheduling the

reduced fleet more efficiently and with the addition of our new, low-fare service to Hawaii in December 2005, we expect to create approximately

$175 million in annual operating synergies. We also expect to 50