US Airways 2005 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2005 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

the credit card servicers and the exercise of remedies by our creditors and lessors. In such a situation, it is unlikely that we would be able to fulfill our

contractual obligations, repay the accelerated indebtedness, make required lease payments or otherwise cover our fixed costs.

We may not perform as well financially as we expect following the merger.

In deciding to enter into the merger agreement, US Airways Group and America West Holdings considered the benefits of operating as a combined

company, including, among others, an enhanced ability to compete in the airline industry and the fact that the proprietary brands of the combined company

would permit US Airways Group to further differentiate itself from other airline companies. The success of the merger will depend, in part, on our ability to

realize the anticipated revenue opportunities and cost savings from combining the businesses of US Airways Group and America West Holdings. We have

estimated that the combined companies expect to realize approximately $600 million in incremental operating cost and revenue synergies. We cannot assure

you, however, that these synergies will be realized. To realize the anticipated benefits from the merger, we must successfully combine the businesses of

US Airways Group and America West Holdings in a manner that permits those costs savings and other synergies to be realized in a timely fashion. In

addition, we must achieve these savings without adversely affecting revenues or suffering a business interruption. If we are not able to successfully achieve

these objectives, the anticipated benefits of the merger may take longer to realize than expected or may not be realized fully or at all.

The integration of US Airways Group and America West Holdings following the merger presents significant challenges.

US Airways Group and America West Holdings will face significant challenges in consolidating functions, integrating their organizations, procedures and

operations in a timely and efficient manner and retaining key Company personnel. The integration of US Airways Group and America West Holdings will be

costly, complex and time consuming, and management will have to devote substantial effort to that integration that could otherwise be spent on operational

matters or other strategic opportunities. We expect that the merger will result in certain synergies, business opportunities and growth prospects. We, however,

may never realize these expected synergies, business opportunities and growth prospects. US Airways Group may experience increased competition that

limits its ability to expand its business. We may not be able to capitalize on expected business opportunities, including retaining current customers. In

addition, assumptions underlying estimates of expected cost savings and expected revenue synergies may be inaccurate, or general industry and business

conditions may deteriorate. Furthermore, integrating operations will require significant efforts and expenses. Our management may have its attention diverted

from ongoing operations while trying to integrate.

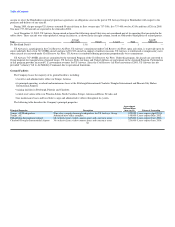

US Airways Group continues to experience significant operating losses.

Despite significant labor cost reductions and other cost savings achieved in the prior bankruptcies, US Airways Group has continued to experience

significant operating losses through 2005. Since early 2001, the U.S. airline industry's revenue performance has fallen short of what would have been

expected based on historical growth trends. This shortfall has been caused by a number of factors, including rising fuel costs, as discussed above, and the

factors discussed below.

Low cost carriers (including AWA and the new US Airways) have had a profound impact on industry revenues. Using the advantage of low unit costs,

these carriers offer lower fares, particularly those targeted at business passengers, in order to shift demand from larger, more-established airlines. Some low

cost carriers, which have cost structures lower than ours, have better financial performance and more cost effective access to capital to fund fleet growth.

These low-cost carriers are expected to continue to increase their market share through pricing and growth and could continue to have an impact on the overall

performance of US Airways Group. 20