US Airways 2005 Annual Report Download - page 226

Download and view the complete annual report

Please find page 226 of the 2005 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

US Airways, Inc.

Notes to the Financial Statements — (Continued)

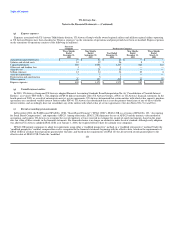

is immediately recognized in earnings. As of December 31, 2005, US Airways had no open fuel hedge positions in place. See Note 5 for more information on

US Airways' derivative financial instruments.

US Airways' results of operations can be significantly impacted by changes in the price of aircraft fuel. To manage this risk, US Airways periodically

enters into fixed price swap agreements, collar structures and other similar instruments. These agreements substantially fix US Airways' cash flows related to

fuel expense. Because jet fuel derivatives are significantly less liquid and relatively more expensive, US Airways primarily uses heating oil and crude oil

contracts to manage its exposure to the movement of aircraft fuel prices. The changes in the market value of the heating oil and crude oil contracts have a high

correlation to changes in aircraft fuel prices. The agreements generally qualify as cash flow hedges under SFAS 133. US Airways does not purchase or hold

any derivative financial instruments for trading purposes.

US Airways records the fair market value of its fuel hedge contracts on its balance sheets. On an ongoing basis, US Airways adjusts its balance sheet to

reflect the current fair market value of its fuel hedge contracts. The related gains or losses on these contracts are deferred in accumulated other comprehensive

income until the hedged fuel is recognized into earnings. However, to the extent that the absolute change in the value of the fuel hedge contract exceeds the

absolute change in the value of the aircraft fuel purchase being hedged, the difference is considered "ineffective" and is immediately recognized in earnings as

either gain or loss. The amount recognized in earnings may reverse in following periods if the relationship reverses. The fuel hedge contracts' gains and losses

including those classified as "ineffective" are recognized to aircraft fuel and related taxes on the statements of operations, except for those related to hedging

purchases of aviation fuel under its capacity purchase agreements, which are recorded to Express expenses. Due to the application of fresh-start reporting,

US Airways recognized a one-time gain of $6 million related to unrecognized fuel hedge gains included in reorganization items, net for the nine months ended

September 30, 2005.

US Airways holds stock options in Sabre Holding Corporation ("Sabre") and warrants in a number of e-commerce companies as a result of service

agreements with them. On an ongoing basis, US Airways adjusts its balance sheet to reflect changes in the current fair market value of the stock options and

warrants to Other, net on its statements of operations. See Note 5 for more information on these options and warrants.

(k) Deferred gains and credits, net

In connection with fresh-start reporting, aircraft operating leases were adjusted to fair value and deferred credits of $190 million were established in the

accompanying balance sheet representing the net present value of the difference between stated lease rates and the fair market rates. These deferred credits are

amortized on a straight-line basis as a decrease to aircraft rent expense over the applicable remaining lease periods, generally one to 17 years. In periods prior

to the adoption of fresh-start reporting, gains on aircraft sale and leaseback transactions were deferred and amortized over the terms of the leases as a

reduction of the related aircraft rent expense.

The gain related to the exercise of Sabre options is deferred and amortized over the contract period as a reduction to other operating expenses. See Note 5

for more information related to the Sabre options.

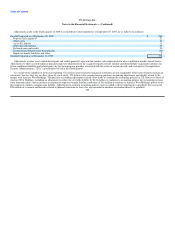

(l) Passenger revenue

Passenger revenue is recognized when transportation is provided. Ticket sales for transportation that has not yet been provided are initially recorded as air

traffic liability on the balance sheet. The air traffic liability represents tickets sold for future travel dates and estimated future refunds and exchanges of tickets

sold for past travel dates. The majority of tickets sold on US Airways are nonrefundable. Tickets that are

220