US Airways 2005 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2005 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

$275 million are to be applied pro rata across all maturities in accordance with the loan's early amortization provisions. US Airways made prepayments

totaling $156 million in connection with these specified asset sales completed during 2005.

Certain third party counter-guarantors have fully and unconditionally guaranteed the payment of an aggregate amount of $11 million of the remaining

principal amount of the AWA loan, plus accrued and unpaid interest thereon, as of December 31, 2005. The AWA loan previously bore interest at a rate of

LIBOR plus 40 basis points, with a guarantee fee equal to 8.0% per annum with annual increases of 5 basis points. As a result of the sale of the AWA loan,

the non-guaranteed portion of the loan is no longer subject to the annual guarantee fee, but instead bears interest at a rate per annum equal to LIBOR plus

840 basis points, increasing by 5 basis points on January 18 of each year, beginning January 18, 2006, through the end of the loan term, payable on a quarterly

basis. The amortization payments under the AWA loan become due in seven installments of $42 million on each March 31 and September 30, commencing

on September 30, 2005 and ending on September 30, 2008. The AWA loan also requires a premium, in certain instances, for voluntary prepayments. AWA

made a voluntary prepayment of $9 million dollars in principal amount on September 27, 2005, after the closing of the AWA loan, prepaying in full the

portion of the loan subject to one of the counter-guarantees, which prepayment has been applied pro rata against each scheduled amortization payment.

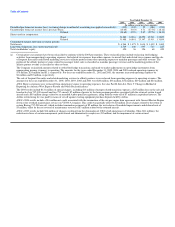

The terms of both amended and restated loans require US Airways Group to meet certain financial covenants, including minimum cash requirements and

required minimum ratios of earnings before interest, taxes, depreciation, amortization and aircraft rent to fixed charges, starting with the quarter ended

December 31, 2005. At December 31, 2005, the Company is in compliance with these covenants.

New Convertible Notes — On September 30, 2005, US Airways Group issued $144 million aggregate principal amount of 7% Senior Convertible Notes

due 2020 for proceeds, net of expenses, of approximately $139 million. The 7% notes are US Airways Group's senior unsecured obligations and rank equally

in right of payment to its other senior unsecured and unsubordinated indebtedness and are effectively subordinated to its secured indebtedness to the extent of

the value of assets securing such indebtedness. The 7% notes are fully and unconditionally guaranteed, jointly and severally and on a senior unsecured basis,

by US Airways Group's two major operating subsidiaries, US Airways and AWA. The guarantees are the guarantors' unsecured obligations and rank equally

in right of payment to the other senior unsecured and unsubordinated indebtedness of the guarantors and are effectively subordinated to the guarantors'

secured indebtedness to the extent of the value of assets securing such indebtedness.

Restructuring of Affinity Credit Card Partner Agreement — In connection with the merger, AWA, US Airways Group and Juniper Bank, a subsidiary of

Barclays PLC, entered into an agreement on August 8, 2005 amending AWA's co-branded credit card agreement with Juniper, dated January 25, 2005.

Pursuant to the amended credit card agreement, Juniper agreed to offer and market an airline mileage award credit card program to the general public to

participate in US Airways Group's Dividend Miles program through the use of a co-branded credit card.

US Airways Group's credit card program is currently administered by Bank of America, N.A. (USA). On December 28, 2005, US Airways issued a notice

of termination under its agreement with Bank of America and that notice will become effective on December 28, 2007. Pending termination of the Bank of

America agreement, both Juniper and Bank of America will run separate credit card programs for US Airways Group. The amended credit card agreement is

the subject of pending litigation filed by Bank of America against US Airways Group, US Airways and AWA. (See also Part I, Item 3, "Legal Proceedings.")

The amended credit card agreement took effect at the effective time of the merger. The credit card services provided by Juniper under the amended credit

card agreement began in January 2006, and will continue until the expiration date, which is the later of December 31, 2012 or seven years from the date on

which Juniper commences marketing to the general public. 47