US Airways 2005 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2005 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

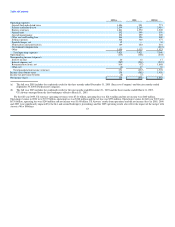

(g) In connection with filing for bankruptcy on September 12, 2004, US Airways achieved cost-savings agreements with its principal collective bargaining

groups. In connection with the new labor agreements, approximately 5,000 employees across several of US Airways' labor groups were involuntarily

terminated or participated in voluntary furlough and termination programs.

(h) In connection with the Airbus MOU, US Airways was required to pay a restructuring fee of $39 million, which was paid by means of offset against

existing equipment deposits held by Airbus. US Airways also received credits from Airbus totaling $4 million in 2005, primarily related to equipment

deposits. See also Note 1 to US Airways' financial statements included in Item 8C of this report.

(i) The GE Merger MOU provided for the continued use of certain leased Airbus, Boeing and regional jet aircraft, the modification of monthly lease rates

and the return of certain other leased Airbus and Boeing aircraft. The GE Merger MOU also provided for the sale-leaseback of assets securing various

GE obligations. In connection with these transactions, US Airways recorded a net loss of $5 million.

In connection with the first bankruptcy, US Airways restructured aircraft debt and lease agreements related to 119 aircraft including the conversion of

52 mortgages to operating leases. The restructured terms generally provide for shorter lease periods and lower lease rates.

(j) For the three months ended March 31, 2003, reorganization items includes expenses related to seven aircraft that were legally abandoned as part of the

first bankruptcy. Related aircraft liabilities were adjusted for each aircraft's expected allowed collateral value.

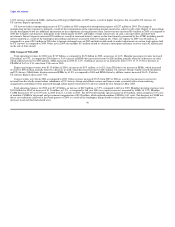

Liquidity and Capital Resources

Sources and Uses of Cash

US Airways Group

As of December 31, 2005, US Airways Group's cash, cash equivalents, short-term investments and restricted cash were $2.38 billion, of which

$1.58 billion was unrestricted. The merger of US Airways Group and America West Holdings resulted in more than $1.7 billion in new liquidity from equity

investments, a common stock offering, a convertible debt offering, cash infusions from commercial partners and asset-based financings. US Airways Group

has the ability to move funds freely between operating subsidiaries to support operations. These transfers are recognized as intercompany transactions. The

Company believes that cash flows from operating activities, combined with cash balances and financing commitments, will be adequate to fund operating and

capital needs as well as to maintain compliance with its various debt arrangements through the end of 2006.

As discussed above in "Emergence and Merger Transactions," obtaining additional financing and liquidity to fund operations was critical to US Airways

Group's emergence from bankruptcy and merger with America West Holdings. Several new equity investors provided an aggregate of $565 million of initial

equity investments, and exercised the full amount of options they held for additional equity of $113 million. The public stock offering completed on

September 30, 2005 provided an additional $180 million in net proceeds, and the convertible notes offering completed on September 30, 2005 provided an

additional $139 million in net proceeds. In addition, US Airways Group has received over $700 million of cash infusions from commercial partners, including

approximately $455 million from an affinity credit card partner received in October 2005 and a $250 million line of credit provided by Airbus, and

approximately $127 million from asset-based financings or sales of aircraft, net after prepayments of US Airways' ATSB loan.

Net cash provided by operating activities was $46 million and $21 million in 2005 and 2004, respectively. The 2005 period included the receipt of a

$150 million one-time bonus payment from an affinity credit card partner and a $120 million release of certain restricted cash. These increases were offset in

part by the loss before cumulative effect of change in accounting principle ($335 million) in 2005. The 2004 period included a decrease in accounts payable

$35 million, due to the timing of vendor payments and the payment in February 2004 of $20 million related to the execution of a new pilot agreement, which

70