US Airways 2005 Annual Report Download - page 193

Download and view the complete annual report

Please find page 193 of the 2005 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

America West Airlines, Inc.

Notes to Consolidated Financial Statements — (Continued)

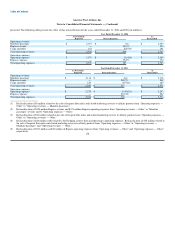

amount of notes exchanged represented approximately 99% of the outstanding principal amount, and approximately $2 million in principal amount at

maturity of the notes remained outstanding after the exchange. On November 30, 2005, US Airways Group issued a total of 38,864 shares of its

common stock to repurchase the remaining outstanding principal amount of the notes.

(h) The industrial development revenue bonds are due April 2023. Interest at 6.3% is payable semiannually on April 1 and October 1. The bonds are

subject to optional redemption prior to the maturity date on or after April 1, 2008, in whole or in part, on any interest payment date at the following

redemption prices: 102% on April 1 or October 1, 2008; 101% on April 1 or October 1, 2009; and 100% on April 1, 2010 and thereafter.

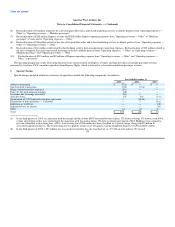

(i) In connection with the merger, AWA, US Airways Group and Juniper Bank, a subsidiary of Barclays PLC (Juniper), entered into an agreement on

August 8, 2005 amending AWA's co-branded credit card agreement with Juniper, dated January 25, 2005. Pursuant to the amended credit card

agreement, Juniper agreed to offer and market an airline mileage award credit card program to the general public to participate in US Airways Group's

Dividend Miles program through the use of a co-branded credit card.

US Airways Group's credit card program is currently administered by Bank of America, N.A. (USA). On December 28, 2005, US Airways issued a

notice of termination under its agreement with Bank of America and that notice will become effective on December 28, 2007. Pending termination of

the Bank of America agreement, both Juniper and Bank of America will run separate credit card programs for US Airways Group. The amended credit

card agreement is the subject of pending litigation filed by Bank of America against US Airways Group, US Airways and AWA (See Note 9(e)).

The amended credit card agreement took effect at the effective time of the merger. The credit card services provided by Juniper under the amended

credit card agreement began in January 2006, and will continue until the expiration date, which is the later of December 31, 2012 or seven years from

the date on which Juniper commences marketing to the general public.

Under the amended credit card agreement, Juniper will pay to US Airways Group fees for each mile awarded to each credit card account administered

by Juniper, subject to certain exceptions. Pursuant to the original credit card agreement, Juniper paid to AWA a bonus of $20 million. Juniper also

agreed to pay a one-time bonus payment of $130 million, following the effectiveness of the merger, subject to certain conditions. The $130 million

bonus payment was made to AWA on October 3, 2005. The entire $150 million balance for bonus payments are included in "Deferred gains and other

liabilities" in the accompanying consolidated balance sheet as of December 31, 2005. US Airways Group will not recognize any revenue from the

bonus payments until the dual branding period has expired, approximately February 2008. At that time the Company expects to begin recognizing

revenue from the bonus payments on a straight-line basis through December 2012, the expiration date of the Juniper agreement. Further, if Juniper is

not granted exclusivity to offer a co-branded credit card after the dual branding period, US Airways Group must repay the bonus payments and

repurchase unused pre-paid miles with interest, plus $50 million in liquidated damages. Juniper will pay an annual bonus of $5 million to US Airways

Group, subject to certain exceptions, for each year after Juniper becomes the exclusive issuer of the co-branded credit card.

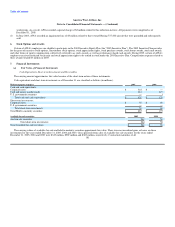

On October 3, 2005, Juniper pre-paid for miles from US Airways Group totaling $325 million, subject to the same conditions as apply to the

$130 million bonus payment. To the extent that these miles are not used by Juniper as allowed under the co-branded credit card program in certain

circumstances, US Airways Group will repurchase these miles in 12 equal quarterly installments beginning on the fifth year prior to the expiration date

of the co-branded credit card agreement with Juniper, until paid in full. US Airways Group makes monthly interest payments at LIBOR plus 4.75% to

Juniper, beginning on November 1, 2005, based on the amount of pre-purchased miles that have not been used

187