US Airways 2005 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2005 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

US Airways Group, Inc.

Notes to Consolidated Financial Statements — (Continued)

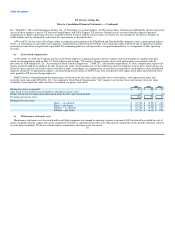

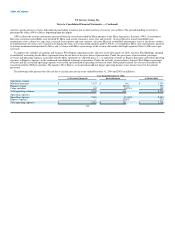

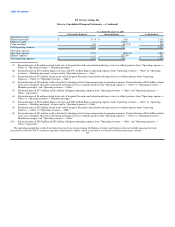

returned in the fourth quarter of 2004 and one was returned in January 2005. In addition, AWA continues negotiating with one lessor on the return of its

remaining two Boeing 737-200 aircraft, one of which was parked in March 2002. The other aircraft was removed from service in January 2005. In

connection with the return of the aircraft, AWA recorded $2 million of special charges in 2004, which include lease termination payments of $2 million

and the write-down of leasehold improvements and aircraft rent balances of $3 million, offset by the net reversal of lease return provisions of

$3 million. In the first quarter of 2005, AWA recorded $1 million in special charges related to the final Boeing 737-200 aircraft, which was removed

from service in January 2005.

(g) In the first quarter of 2004, AWA recorded a $1 million reduction in special charges related to the revision of estimated costs associated with the sale

and leaseback of certain aircraft.

(h) In December 2004, AWA and GE mutually agreed to terminate the V2500 A-1 power by hour ("PBH") agreement effective January 1, 2005. This

agreement was entered into March 1998 with an original term of ten years. For terminating the agreement early, AWA received a $20 million credit to

be applied to amounts due for other engines under the 1998 agreement. AWA had capitalized PBH payments for V2500 A-1 engines in excess of the

unamortized cost of the overhauls performed by GE of approximately $4 million. With the termination of this agreement, these payments were not

realizable and as a result, AWA wrote off this amount against the $20 million credit referred to above, resulting in a $16 million net gain.

(i) In the first quarter of 2003, AWA recorded a $1 million reduction in special charges related to the earlier-than-planned return of certain leased aircraft

in 2001 and 2002, as all payments related to these aircraft returns had been made.

(j) In February 2003, AWA announced the elimination of its hub operations in Columbus, Ohio. As a result, 12 regional jets, all of which were operated by

Chautauqua Airlines under the America West Express banner, were phased out of the fleet. In addition, the hub was downsized from 49 daily departures

to 15 destinations to four flights per day to Phoenix and Las Vegas. Service to New York City LaGuardia Airport was also eliminated because

perimeter rules at the airport prohibit flights beyond 1,500 miles, precluding service from AWA's hubs in Phoenix and Las Vegas. In the first, second

and third quarters of 2003, AWA recorded special charges totaling $11 million related to the costs associated with the termination of certain aircraft and

facility contracts, employee transfer and severance expenses and the write-off of leasehold improvements in Columbus, Ohio. All payments were

completed as of December 31, 2005.

(k) In April 2003, as part of a cost reduction program, AWA implemented a plan to reduce management, professional and administrative payroll costs that

resulted in 161 fewer employees within these workgroups. As a result, AWA recorded a special charge of $2 million related to this reduction-in-force.

All payments were completed as of December 31, 2005.

(l) In June 2003, AWA recorded an impairment loss of $3 million related to three owned Boeing 737-200 aircraft that were grounded and subsequently

sold.

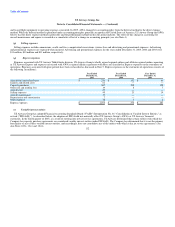

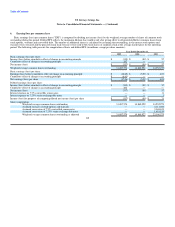

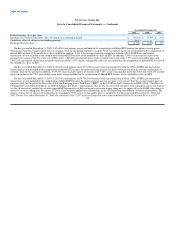

8. Financial instruments

(a) General

On January 1, 1998, as part of a comprehensive information technology services agreement with Sabre, US Airways was granted two tranches of stock

options (SHC Stock Options) to acquire up to 6,000,000 shares of Class A Common Stock, $.01 par value, of Sabre Holdings Corporation (SHC Common

Stock), Sabre's parent company. Each tranche included 3,000,000 stock options. In December 1999, US Airways exercised the first tranche of stock options at

an exercise price of $27 per option and received proceeds of $81 million in January 2000 in lieu of receiving SHC Common Stock. Realized gains resulting

from the exercise of Sabre options are subject to a clawback provision. Under the clawback

121