US Airways 2005 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2005 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Passenger revenue

Passenger revenue is recognized when transportation is provided. Ticket sales for transportation that has not yet been provided are initially deferred and

recorded as air traffic liability on the balance sheet. The air traffic liability represents tickets sold for future travel dates and estimated future refunds and

exchanges of tickets sold for past travel dates. The balance in the air traffic liability fluctuates throughout the year based on seasonal travel patterns and fare

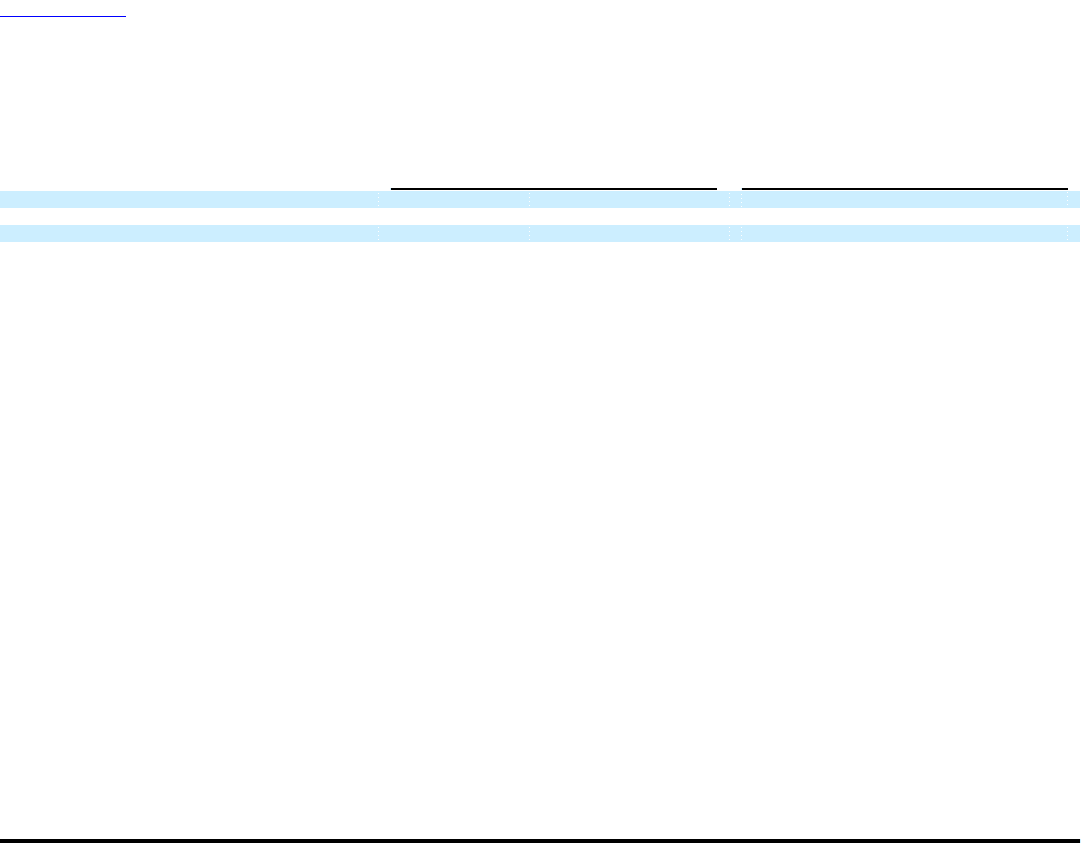

sale activity. The air traffic liability was as follows (in millions):

December 31, 2005 December 31, 2004

US Airways Group $ 788 $ 195

AWA $ 218 $ 195

US Airways $ 570 $ 615

The majority of the Company's tickets sold are nonrefundable. Tickets that are sold but not flown on the travel date may be reused for another flight, up to

a year from the date of sale, or refunded, if the ticket is refundable, after taking into account any cancellation penalties or change fees. A small percentage of

tickets, or partially used tickets, expire unused. Due to complex pricing structures, refund and exchange policies, and interline agreements with other airlines,

certain amounts are recognized in revenue using estimates regarding both the timing of the revenue recognition and the amount of revenue to be recognized.

These estimates are generally based on the analysis of our historical data. Estimated future refunds and exchanges included in the air traffic liability are

routinely evaluated based on subsequent activity to validate the accuracy of the Company's estimates. Holding other factors constant, a ten percent change in

the Company's estimate of the amount refunded, exchanged or forfeited for 2005 would result in a $10 million and $22 million change in passenger revenue

for AWA and US Airways, respectively.

Passenger traffic commissions and related fees are expensed when the related revenue is recognized. Passenger traffic commissions and related fees not

yet recognized are included as a prepaid expense.

In connection with the application of purchase accounting, US Airways recorded a $124 million reduction to its air traffic liability to conform its

accounting policies for recognizing revenue from expired tickets to those of America West Holdings. US Airways experienced changes in customer travel

patterns resulting from various factors, including new airport security measures, concerns about further terrorist attacks and an uncertain economy, resulting in

more forfeited tickets and fewer refunds. Therefore, during the fourth quarter of 2003, US Airways recorded a $34 million favorable adjustment to mainline

passenger revenue to reflect an increase in expired tickets.

Impairment of Goodwill

SFAS No. 142, "Goodwill and Other Intangible Assets" requires that goodwill be tested for impairment at the reporting unit level on an annual basis and

between annual tests if an event occurs or circumstances change that would more likely than not reduce the fair value of the reporting unit below its carrying

value. The Company believes that this accounting estimate is a critical accounting estimate because: (1) goodwill is a significant asset and (2) the impact that

recognizing an impairment would have on the asset reported on the consolidated balance sheet, as well as the consolidated statement of operations, could be

material.

The Company assesses the fair value of the reporting unit considering both the income approach and market approach. Under the market approach, the fair

value of the reporting unit is based on quoted market prices and the number of shares outstanding for US Airways Group common stock. Under the income

approach, the fair value of the reporting unit is based on the present value of estimated future cash flows. The income approach is dependent on a number of

factors including estimates of future market growth trends, forecasted revenues and expenses, expected periods the assets will be utilized, appropriate discount

rates and other variables. The Company bases its estimates on assumptions that it believes to be reasonable, but which are unpredictable and inherently

uncertain. Changes in these estimates and 86