US Airways 2005 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2005 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323

|

|

Table of Contents

US Airways Group, Inc.

Notes to Consolidated Financial Statements — (Continued)

become a party to the amended card processing agreement at the time that Chase begins processing for US Airways.

The amended card processing agreement took effect at the effective time of the merger and continues until the expiration of the initial term, which is three

years from the effective date. Upon expiration of the initial term, the amended card processing agreement will automatically renew for successive one-year

periods pursuant to the terms of the agreement.

Under the amended card processing agreement, AWA will pay to Chase fees in connection with card processing services such as sales authorization,

settlement services and customer service. AWA and US Airways are also required to maintain a reserve account to secure Chase's exposure to outstanding air

traffic liability

Asset Based Financings and Sales — In addition to the sale-leaseback transactions completed in June 2005 related to the GE Merger MOU described

above, US Airways also executed flight equipment asset sale and sale-leaseback transactions in the third and fourth quarters of 2005. While transactions

completed prior to the merger date by US Airways are not reflected in the US Airways Group financial statements as a result of accounting for the merger as a

reverse acquisition, these transactions provided additional liquidity and reductions to debt for US Airways Group. US Airways received net proceeds of

$209 million and a reduction in aircraft related debt of $561 million. Additionally during the third quarter, US Airways received net proceeds of $51 million

in connection with an agreement to sell and leaseback certain of its commuter slots at Ronald Reagan Washington National Airport and New York LaGuardia

Airport. US Airways was required to use proceeds totaling $156 million to pay down the US Airways ATSB Loan.

For 2005, AWA executed flight equipment asset sale and leaseback transactions resulting in net proceeds of $23 million and a reduction in aircraft related

debt of $38 million.

2. Basis of presentation and summary of significant accounting policies

(a) Nature of operations and operating environment

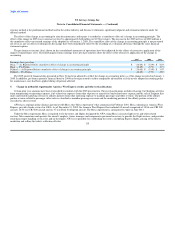

US Airways Group's primary business activity is the operation of a major network air carrier through its ownership of the common stock of US Airways,

America West Holdings, Piedmont Airlines, Inc. ("Piedmont"), PSA Airlines, Inc. ("PSA"), Material Services Company, Inc. ("MSC") and Airways

Assurance Limited, LLC ("AAL").

US Airways and AWA are the Company's principal operating subsidiaries. US Airways and America West Airlines are both certificated air carriers

engaged primarily in the business of transporting passengers, property and mail. US Airways and AWA enplaned approximately 42 million and 22 million

passengers, respectively, in 2005. Combined, US Airways and America West Airlines are the fifth largest U.S. air carrier, as ranked by domestic revenue

passenger miles ("RPMs") and domestic available seat miles ("ASMs"). As of December 31, 2005, US Airways operated 232 jet aircraft and 18 regional jet

aircraft and AWA operated 141 jet aircraft and 62 regional jet aircraft. During 2005, US Airways provided regularly scheduled service or seasonal service at

91 airports in the continental United States, Canada, Mexico, France, Germany, Italy, Spain, Ireland, the Netherlands, the United Kingdom and the Caribbean

and AWA provided regularly scheduled service at 64 airports in North America, including eight in Mexico, four in Canada and one in Costa Rica.

Most of the airline operations are in competitive markets. Competitors include other air carriers along with other modes of transportation. As of

December 31, 2005, US Airways Group employed approximately 36,600 active full time equivalent employees. Approximately 80% of US Airways Group's

employees are covered by collective bargaining agreements with various labor unions.

105