US Airways 2005 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2005 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

US Airways Group, Inc.

Notes to Consolidated Financial Statements — (Continued)

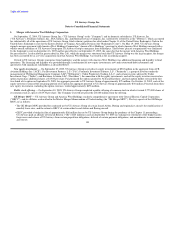

(b) Basis of presentation

The merger has been accounted for as a reverse acquisition using the purchase method of accounting. Although the merger was structured such that

America West Holdings became a wholly owned subsidiary of US Airways Group, America West Holdings has been treated as the acquiring company for

accounting purposes under Statement of Financial Accounting Standards ("SFAS") No. 141 "Business Combinations," due to the following factors:

(1) America West Holdings' stockholders received the larger share of the Company's common stock in the merger in comparison to the unsecured creditors of

US Airways; (2) America West Holdings received a larger number of designees to the board of directors; and (3) America West Holdings' Chairman and

Chief Executive Officer prior to the merger became the Chairman and Chief Executive Officer of the combined company. As a result of the reverse

acquisition, the statements of operations presented include the results of America West Holdings for the year ended December 31, 2005 and consolidated

results of US Airways Group for the period from September 27, 2005 through December 31, 2005. The financial information reflected in the financial

statements for periods prior to the merger are comprised of the accounts and activities of America West Holdings, the holding company of AWA.

The accompanying consolidated financial statements include the accounts of US Airways Group and its wholly owned subsidiaries. Principal subsidiaries

include US Airways, AWA, Piedmont and PSA. US Airways Group has the ability to move funds freely between its operating subsidiaries to support

operations. These transfers are recognized as intercompany transactions. All significant intercompany accounts and transactions have been eliminated. As

discussed further in Note 15, the financial results of US Airways Group and its wholly owned subsidiaries include certain related party transactions. The

preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make

estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial

statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. The principal

areas of judgment relate to passenger revenue recognition, impairment of long-lived assets and intangible assets, the frequent traveler program and estimates

of fair value for assets and liabilities established in fresh-start reporting and purchase accounting.

The Company classified revenue and expenses associated with its wholly owned regional airline subsidiaries, US Airways' MidAtlantic division and

affiliate regional airlines under capacity purchase agreements as Express revenue and Express expenses in the accompanying consolidated statement of

operations.

Certain prior year amounts have been reclassified to conform with the 2005 presentation. In the first quarter of 2005, AWA changed its method of

reporting for its regional alliance agreement with Mesa Airlines ("Mesa") from the net basis of presentation to the gross basis of presentation. See also Note 5

for additional information about the agreement with Mesa and the reclassifications related to the change in presentation.

(c) Cash equivalents and short-term investments

Cash equivalents and short-term investments consist primarily of cash in money market securities of various banks, highly liquid debt instruments,

commercial paper and asset-backed securities of various financial institutions and securities backed by the U.S. Government. All highly liquid investments

purchased within three months of maturity are classified as cash equivalents. All other highly liquid investments are classified as short-term investments.

Investments in auction rate securities are classified as short-term investments on the accompanying consolidated balance sheets.

106