US Airways 2005 Annual Report Download - page 222

Download and view the complete annual report

Please find page 222 of the 2005 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

US Airways, Inc.

Notes to the Financial Statements — (Continued)

concentration of significant operations in the eastern U.S. results in US Airways being susceptible to changes in certain regional conditions that may have an

adverse effect on the US Airways' financial condition and results of operations.

As of December 31, 2005, US Airways employed approximately 20,100 full-time equivalent employees. Approximately 86% of US Airways' active

employees are covered by collective bargaining agreements with various labor unions.

(b) Basis of presentation and use of estimates

The accompanying financial statements include the accounts of US Airways. US Airways is a wholly owned subsidiary of US Airways Group.

US Airways Group has the ability to move funds freely between its operating subsidiaries to support operations. These transfers are recognized as

intercompany transactions. In the accompanying statement of cash flows, these intercompany transactions are designated as payable to affiliate and are

classified as operating activities as it is US Airways Group's intent to settle these transactions in the near term. As discussed further in Note 11, US Airways'

financial results are significantly influenced by related party transactions. Certain prior year amounts have been reclassified to conform with the 2005

presentation. Among these reclassifications, passenger revenue associated with US Airways' MidAtlantic division and US Airways Group's wholly owned

regional airlines and affiliate regional airlines operating as US Airways Express have been reclassified as "Express passenger." Expenses associated with

US Airways' MidAtlantic division, US Airways Group's wholly owned regional airlines and affiliate regional airlines operating as US Airways Express have

been reclassified under the "Express expenses" caption. See Note 2(p) for additional information related to Express expenses.

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management

to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the

financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. The

principal areas of judgment relate to passenger revenue recognition, impairment of long-lived assets and intangible assets, the frequent traveler program,

estimates of fair value for assets and liabilities established in fresh-start reporting and purchase accounting and pensions and other postretirement benefit

obligations.

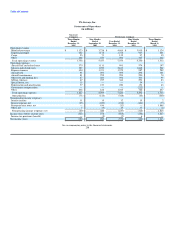

In connection with emergence from its first bankruptcy in March 2003 and its second bankruptcy in September 2005, US Airways adopted fresh-start

reporting in accordance with AICPA Statement of Position 90-7, "Financial Reporting by Entities in Reorganization Under the Bankruptcy Code"

("SOP 90-7"). As a result of the application of fresh-start reporting, the financial statements prior to March 31, 2003 are not comparable with the financial

statements for the period April 1, 2003 to September 30, 2005, nor is either period comparable to periods after September 30, 2005. References to "Successor

Company" refer to US Airways on and after September 30, 2005, after giving effect to the application of fresh-start reporting for the second bankruptcy and

purchase accounting. References in the financial statements and the notes to the financial statements to "Predecessor Company" refer to US Airways prior to

September 30, 2005. While the effective date of the plan of reorganization and the merger was September 27, 2005, the results of operations for US Airways

during the four day period from September 27 through September 30, 2005 are not material to the financial statement presentation.

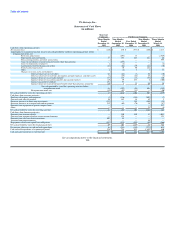

SOP 90-7 requires that the financial statements for periods following the Chapter 11 filing through the emergence date distinguish transactions and events

that are directly associated with the reorganization from the ongoing operations of the business. Accordingly, revenues, expenses, realized gains and losses

and provisions for losses incurred prior to emergence and directly associated with the reorganization and restructuring of the business are reported separately

as Reorganization items, net in the statements of operations. The balance sheet as of December 31, 2004 distinguishes pre-petition liabilities subject to

216