US Airways 2005 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2005 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

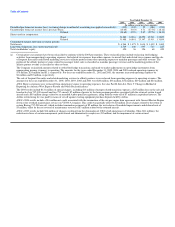

operating revenues and ASMs and RPMs, AWA was the eighth largest passenger airline and the second largest low-cost carrier in the United States. AWA

was the largest low-cost carrier operating a hub-and-spoke network before the merger, with hubs in both Phoenix, Arizona and Las Vegas, Nevada. As of

December 31, 2005, AWA operated a fleet of 141 aircraft and served 64 destinations in North America, including eight in Mexico, two in Hawaii, four in

Canada and one in Costa Rica. In 2005, AWA had approximately 22 million passengers boarding its planes and generated mainline passenger revenues of

approximately $2.52 billion.

On September 12, 2004, US Airways Group and its domestic subsidiaries, US Airways, Piedmont, PSA and Material Services Company, which at the

time accounted for substantially all of the operations of US Airways Group, filed voluntary petitions for relief under Chapter 11 of the Bankruptcy Code in the

United States Bankruptcy Court for the Eastern District of Virginia, Alexandria Division. On May 19, 2005, US Airways Group signed a merger agreement

with America West Holdings pursuant to which America West Holdings merged with a wholly owned subsidiary of US Airways Group. The merger

agreement was amended by a letter agreement on July 7, 2005. The merger became effective upon US Airways Group's emergence from bankruptcy on

September 27, 2005.

Following the merger, US Airways Group began moving toward operating under the single brand name of "US Airways" through its two principal

subsidiaries: US Airways and AWA. US Airways Group expects to integrate the two principal subsidiaries into one operation over the first 24 months

following the merger. As a result of the merger, US Airways Group, through its two principal operating subsidiaries, operates the fifth largest airline in the

United States as measured by domestic RPMs and ASMs. The Company has primary hubs in Charlotte, Philadelphia and Phoenix and secondary hubs/focus

cities in Pittsburgh, Las Vegas, New York, Washington, D.C. and Boston. The Company is a low-cost carrier offering scheduled passenger service on

approximately 3,700 flights daily to 233 cities in the U.S., Canada, the Caribbean, Latin America and Europe, making it the only low-cost carrier with a

significant international route presence. Starting in December 2005, we expanded our route network to include Hawaii. As of December 31, 2005,

US Airways Group's two principal subsidiaries operate 373 mainline jets and are supported by its regional airline subsidiaries and affiliates operating as

US Airways Express, which operate approximately 255 regional jets, of which 80 have 70 or more seats, and approximately 107 turboprops.

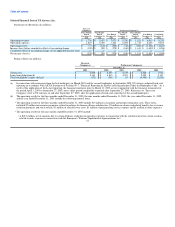

The merger has been accounted for as a reverse acquisition using the purchase method of accounting. As a result, although the merger was structured such

that America West Holdings became a wholly owned subsidiary of US Airways Group, America West Holdings was treated as the acquiring company for

accounting purposes due to the following factors: (1) America West Holdings' stockholders received the largest share of US Airways Group's common stock

in the merger in comparison to unsecured creditors of US Airways Group; (2) America West Holdings received a larger number of designees to the board of

directors; and (3) America West Holdings' Chairman and Chief Executive Officer prior to the merger became the Chairman and Chief Executive Officer of

the combined company. As a result of the reverse acquisition, the 2005 consolidated statement of operations for the new US Airways Group presented in this

report includes the results of America West Holdings for the 269 days through September 27, 2005 and consolidated results of US Airways Group for the

96 days from September 27, 2006 through December 31, 2005. The results of operations for fiscal years 2004 and 2003 are those of America West Holdings.

Emergence and Merger Transactions

The New Equity Investments — On September 27, 2005, US Airways Group received new equity investments of $565 million in the aggregate from ACE

Aviation Holdings Inc. ("ACE"); Par Investment Partners, L.P. ("Par"); Peninsula Investment Partners, L.P. ("Peninsula"); a group of investors under the

management of Wellington Management Company, LLP ("Wellington"); Tudor Proprietary Trading, L.L.C. and certain investors advised by Tudor

Investment Corp. (collectively referred to as "Tudor"); and Eastshore Aviation, LLC ("Eastshore"). In connection with the equity investments, each of the

equity investors received an option to purchase additional shares at $15.00 per share. Par purchased the options granted to ACE and Eastshore, and each

option holder exercised the first two-thirds of its option on 44