US Airways 2005 Annual Report Download - page 268

Download and view the complete annual report

Please find page 268 of the 2005 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323

|

|

Table of Contents

US Airways, Inc.

Notes to the Financial Statements — (Continued)

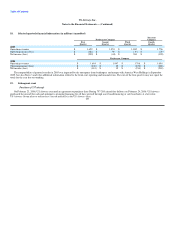

12. Stockholder's equity and dividend restrictions

US Airways Group owns all of US Airways' outstanding common stock, par value $1 per share. US Airways' board of directors has not authorized the

payment of dividends on the common stock since 1988.

US Airways, organized under the laws of the State of Delaware, is subject to Sections 160 and 170 of the Delaware General Corporation Law with respect

to the payment of dividends on or the repurchase or redemption of its capital stock. US Airways is restricted from engaging in any of these activities unless it

maintains a capital surplus. In addition, US Airways may not pay dividends in accordance with provisions contained in the US Airways Citibank Loan.

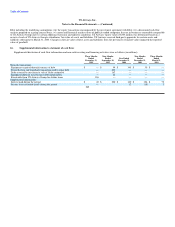

13. Operating segments and related disclosures

US Airways Group is managed as a single business unit that provides air transportation for passengers and cargo. This allows it to benefit from an

integrated revenue pricing and route network that includes US Airways, AWA, Piedmont, PSA and third-party carriers that fly under capacity purchase

agreements as part of US Airways Express. The flight equipment of all these carriers is combined to form one fleet that is deployed through a single route

scheduling system. When making resource allocation decisions, the chief operating decision maker evaluates flight profitability data, which considers aircraft

type and route economics, but gives no weight to the financial impact of the resource allocation decision on an individual carrier basis. The objective in

making resource allocation decisions is to maximize consolidated financial results, not the individual results of US Airways, AWA, Piedmont and PSA.

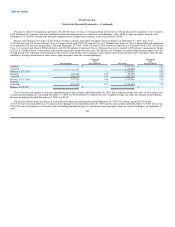

Information concerning operating revenues in principal geographic areas is as follows (in millions):

Successor

Company Predecessor Company

Three Months Nine Months Nine Months Three Months

Ended Ended Year Ended Ended Ended

December 31, September 30, December 31, December 31, March 31,

2005 2005 2004 2003 2003

United States $ 1,502 $ 4,513 $ 5,225 $ 4,456 $ 1,314

Foreign 254 944 1,848 794 198

Total $ 1,756 $ 5,457 $ 7,073 $ 5,250 $ 1,512

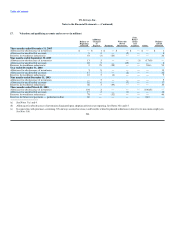

14. Stock-based compensation

Upon confirmation of the Plan of Reorganization, existing shares of US Airways Group's common stock were cancelled. The plan of reorganization

resulted in holders of US Airways Group's common stock and related equity securities receiving no distribution on account of their interest.

After emerging from the first bankruptcy, the Predecessor Company adopted the fair value method of recording stock-based employee compensation

contained in SFAS 123 and accounted for this change in accounting principle using the "prospective method" as described by SFAS 148. Accordingly, the fair

value of all Predecessor Company stock option and warrant grants, as determined on the date of grant, were amortized as compensation expense (an element

of Personnel costs) in the Statement of Operations over the vesting period. The Company has disclosed in Note 2(m) the effect on net income (loss) and net

earnings (loss) per common share as if the fair value based recognition provisions of SFAS 123 had been applied to all outstanding and unvested stock option

awards in each Predecessor Company period presented. 262