US Airways 2005 Annual Report Download - page 237

Download and view the complete annual report

Please find page 237 of the 2005 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

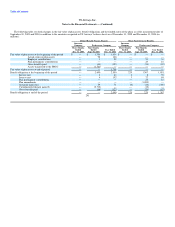

US Airways, Inc.

Notes to the Financial Statements — (Continued)

Reorganization, an additional gain of $1.24 billion was recognized as the liability associated with the postretirement medical benefits was reduced to

fair market value. See also Note 7.

(b) Also in January 2005, US Airways terminated three defined benefit plans related to the flight attendants, mechanics and certain other employees (see

Note 7). The PBGC was appointed trustee of the plans upon termination. US Airways recognized a curtailment gain of $24 million and a $91 million

minimum pension liability adjustment in connection with the terminations in the first quarter of 2005. Upon the effective date of the Plan of

Reorganization and in connection with the settlement with the PBGC, the remaining liabilities associated with these plans were written off, net of

settlement amounts.

Effective March 31, 2003, US Airways terminated its qualified and nonqualified pilot defined benefit pension plans. The PBGC was appointed trustee

of the qualified plan effective with the termination. US Airways recognized a gain in connection with the termination which is partially offset by the

estimate of the PBGC claim.

(c) Reflects the discharge of trade accounts payable and other liabilities upon emergence from bankruptcy. Most of these obligations were only entitled to

receive such distributions of cash and common stock as provided for under the plan of reorganization in each of the bankruptcies. A portion of the

liabilities subject to compromise in the bankruptcies were restructured and continued, as restructured, to be liabilities of the Successor Company.

(d) As a result of US Airways' bankruptcy filing in September 2004, US Airways was not able to secure the financing necessary to take on-time delivery of

three scheduled regional jet aircraft and therefore accrued penalties of $3 million until delivery of these aircraft was made to a US Airways Express

affiliate in August 2005. Offsetting these penalties is the reversal of $33 million in penalties recorded by US Airways in the nine months ended

December 31, 2003 due to its intention not to take delivery of certain aircraft scheduled for future delivery. In connection with the Airbus MOU, the

accrual for these penalties was reversed (see also Notes 1 and 4).

As the result of US Airways' bankruptcy filing in September 2004, it failed to meet the conditions precedent for continued financing of regional jets and

was not able to take delivery of scheduled aircraft and therefore incurred penalties of $7 million in the fourth quarter of 2004.

(e) Damage and deficiency claims are largely a result of US Airways' election to either restructure, abandon or reject aircraft debt and leases during the

bankruptcy proceedings. As a result of the confirmation of the Plan of Reorganization and the effectiveness of the merger, these claims were withdrawn

and the accruals reversed.

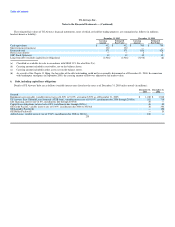

(f) As of September 30, 2005, US Airways recorded $1.5 billion of adjustments to reflect assets and liabilities at fair value, including an initial net write-

down of goodwill of $1.82 billion. Goodwill of $584 million was recorded to reflect the excess of the estimated fair value of liabilities and equity over

identifiable assets. Subsequent to September 30, 2005, US Airways recorded an additional $148 million of goodwill to reflect adjustments to the fair

value of certain assets and liabilities. See Note 3(b) for a description of changes in goodwill during the fourth quarter of 2005.

As of March 31, 2003, US Airways recorded $1.11 billion of adjustments to reflect assets and liabilities at fair value (including a $1.12 billion liability

increase related to the revaluation of US Airways' remaining defined benefit pension plans and postretirement benefit plans and a $333 million write-up

of gates, slots and routes) and the write-off of the Predecessor Company's equity accounts. In addition, goodwill of $2.41 billion was recorded to reflect

the excess of the estimated fair value of liabilities and equity over identifiable assets.

Subsequent to March 31, 2003, US Airways recorded an additional $62 million of adjustments to reflect assets and liabilities at fair value, including a

$281 million decrease to property and equipment, net, a $121 million decrease to long-term debt, net of current maturities, a $13 million increase to

231