US Airways 2005 Annual Report Download - page 243

Download and view the complete annual report

Please find page 243 of the 2005 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323

|

|

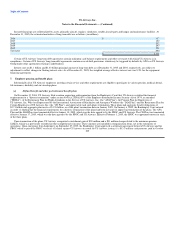

Table of Contents

US Airways, Inc.

Notes to the Financial Statements — (Continued)

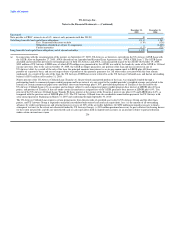

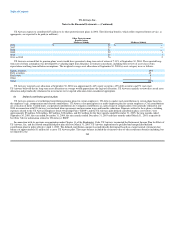

mandatory prepayments made with the net proceeds of future borrowings and issuances of capital stock) not less than:

• $525 million from September 27, 2005 through March 2006;

• $500 million through September 2006;

• $475 million through March 2007;

• $450 million through September 2007;

• $400 million through March 2008;

• $350 million through September 2008; and

• $300 million through September 2010.

US Airways was required to pay down the principal of its loan with the first $125 million of net proceeds from specified asset sales identified in

connection with its Chapter 11 proceedings, whether completed before or after emergence. US Airways then retains the next $83 million of net

proceeds from specified assets sales, and must prepay the principal of the loan with 60% of net proceeds in excess of an aggregate of $208 million from

specified asset sales. Any such asset sales proceeds up to $275 million are to be applied to the outstanding principal balance in order of maturity, and

any such asset sales proceeds in excess of $275 million are to be applied to the outstanding principal balance on a pro rata across all maturities in

accordance with the loan's early amortization provisions. As a result, semi-annual payments are now scheduled to begin on September 30, 2007, instead

of March 31, 2007, as originally scheduled in the loan agreement. US Airways made prepayments totaling $156 million in connection with these

specified asset sales completed during 2005.

(b) In September 2005, US Airways entered into an agreement to sell and leaseback certain of its commuter slots at Ronald Reagan Washington National

Airport and New York LaGuardia Airport. US Airways continues to hold the right to repurchase the slots anytime after the second anniversary of the

slot sale-leaseback transaction. These transactions were accounted for as secured financings. Installments are due monthly through 2015 at a rate of 8%.

(c) Capital lease obligations consist principally of certain airport maintenance and facility leases which expire in 2018 and 2021.

(d) General Electric together with its affiliates (collectively, "GE") finances or leases a substantial portion of US Airways' aircraft prior to the most recent

Chapter 11 filing. In addition, in November 2001, US Airways obtained a $404 million credit facility from GE (the "GE Credit Facility"), which was

secured by collateral including 11 A320-family aircraft and 28 spare engines. In connection with the first bankruptcy, US Airways reached a settlement

with GE that resolved substantially all aircraft, aircraft engine and loan-related issues, and provided US Airways with additional financing from GE in

the form of a liquidity facility of up to $360 million that bore interest at the rate of LIBOR plus 4.25% (the "GE Liquidity Facility"). Most obligations

to GE are cross-defaulted to the US Airways GE Liquidity Facility, GE regional jet leases and GE regional jet mortgage financings.

In November 2004, US Airways reached a comprehensive agreement with GE and its affiliates, as described in a Master Memorandum of

Understanding ("GE Master MOU"), that was approved by the Bankruptcy Court on December 16, 2004. The GE Master MOU, together with the

transactions contemplated by the term sheets attached to the GE Master MOU, provided short-term liquidity, reduced debt, lower aircraft ownership

costs, enhanced engine maintenance services and operating leases for new regional jets, while preserving the vast majority of US Airway's mainline

fleet owned or otherwise financed by GE. In connection with the merger, US Airways and America West Holdings renegotiated certain of their

respective existing agreements, and entered into new agreements, with GE. These agreements are set forth in a comprehensive agreement with GE and

certain of its affiliates in a Master Merger Memorandum of Understanding, referred to as the GE Merger MOU,

237