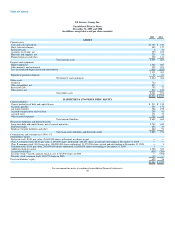

US Airways 2005 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2005 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

As of December 31, 2005 and 2004, Dividend Miles members had accumulated mileage credits for approximately 3.7 million and 4.0 million awards,

respectively. Because US Airways expects that some potential awards will never be redeemed, the calculation of the frequent traveler liability is based on

approximately 76% of potential awards. The liability for the future travel awards was $147 million and $73 million as of December 31, 2005 and 2004,

respectively. The increase in the liability from 2004 to 2005 is a result of changes in the program and related assumptions, including the increased cost of

redemptions on partner airlines and average number of segments for each award. The number of awards redeemed for free travel during the years ended

December 31, 2005, 2004 and 2003 was approximately 1.3 million, 1.5 million and 1.2 million, respectively, representing approximately an average of 9.1%

of US Airways' RPMs for those years. These low percentages as well as the use of certain inventory management techniques minimize the displacement of

revenue passengers by passengers traveling on award tickets. In addition to the awards issued for travel on US Airways, approximately 11% of the total

awards redeemed in 2005 were for travel on partner airlines. A 1% increase or decrease in the percentage of awards on partner airlines would have a

$7 million impact on the liability.

AWA's FlightFund program provides a variety of awards to program members based on accumulated mileage. The estimated cost of providing the free

travel is recognized as a liability and charged to operations as program members accumulate mileage. Similar to US Airways, travel awards are valued at the

incremental cost of carrying one passenger, based on expected redemptions. AWA also sells mileage credits to companies participating in the FlightFund

program, such as hotels, car rental agencies and credit card companies. Transportation-related revenue from the sale of mileage credits is deferred and

recognized when transportation is provided. A change to the estimated cost per mile, minimum award level, percentage of revenue to be deferred or deferred

recognition period could have a significant impact on AWA's revenues or mileage liability accrual in the year of the change as well as future years.

As of December 31, 2005 and 2004, the liability for the future travel awards related to FlightFund was $10 million and $13 million, respectively. The

number of awards redeemed for free travel during the years ended December 31, 2005, 2004 and 2003 was approximately 239,000, 215,000 and 225,000,

respectively, representing an average of 1.7% of AWA's RPMs for those years. These low percentages as well as the use of certain inventory management

techniques minimize the displacement of revenue passengers by passengers traveling on award tickets. In addition to the awards issued for travel on AWA,

approximately 5.6% of the total awards redeemed in 2005 were for travel on partner airlines.

Following the merger, the two frequent flyer programs were modified to allow customers of each airline to earn and use miles on the other airline. We

expect to complete the combination of the two programs under the Dividend Miles name in spring 2006 and plan to merge customer accounts belonging to the

same individual into one Dividend Miles account. At this time, we are unable to estimate the impact that merging customer accounts will have on the liability

for future travel awards.

As discussed above, US Airways and AWA sell mileage credits to participating airline and non-airline business partners. US Airways and AWA defer a

portion of the revenue from these sales. The deferred revenue is recognized over the period in which the credits are expected to be redeemed for travel. A

change to either the period over which the credits are used or the estimated fair value of credits sold could have a significant impact on revenue in the year of

change as well as future years.

Fresh-start reporting and purchase accounting

In connection with its emergence from bankruptcy on September 27, 2005, US Airways adopted fresh-start reporting in accordance with SOP 90-7.

Accordingly, US Airways valued its assets, liabilities and equity at fair value. In addition, as a result of the merger, which is accounted for as a reverse

acquisition under Statement of Financial Accounting Standards ("SFAS") No. 141 "Business Combinations," ("SFAS 141") with America West Holdings as

the accounting acquirer, US Airways Group applied the provisions of SFAS 141 and allocated the purchase price to the assets and liabilities of US Airways

Group and to its wholly owned subsidiaries including US Airways. The purchase price or value of the merger consideration was determined based upon

America West Holdings' traded market 88