US Airways 2005 Annual Report Download - page 224

Download and view the complete annual report

Please find page 224 of the 2005 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

US Airways, Inc.

Notes to the Financial Statements — (Continued)

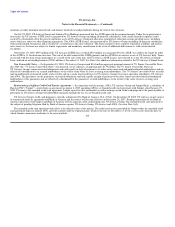

equipment ranged from 5 to 10 years, the estimated useful lives for training equipment and buildings ranged from 10 to 30 years and the estimated useful lives

of owned aircraft, jet engines, flight equipment and rotable parts ranged from 5 to 30 years.

US Airways records impairment losses on long-lived assets used in operations when events and circumstances indicate that the assets might be impaired

as defined by SFAS No. 144, "Accounting for the Impairment or Disposal of Long-Lived Assets" ("SFAS 144"). Recoverability of assets to be held and used

is measured by a comparison of the carrying amount of an asset to undiscounted future net cash flows expected to be generated by the asset. If such assets are

considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying amount of the assets exceeds the fair value of

the assets. Assets to be disposed of are reported at the lower of the carrying amount or fair value less cost to sell.

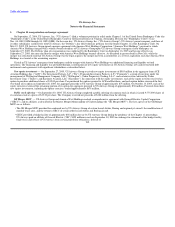

(g) Goodwill and other intangibles, net

At December 31, 2005, goodwill represents the purchase price in excess of the net amount assigned to assets acquired and liabilities assumed by America

West Holdings on September 27, 2005. Since that time, there have been no events or changes that would indicate an impairment to goodwill. US Airways will

perform its next annual impairment test on October 1, 2006. At December 31, 2004, goodwill represents the excess reorganization value resulting from the

application of SOP 90-7 upon emergence from the first bankruptcy. The provisions of SFAS No. 142, "Goodwill and Other Intangible Assets" ("SFAS 142")

require that a two-step impairment test be performed on goodwill. In the first step, the fair value of the reporting unit is compared to its carrying value. If the

fair value of the reporting unit exceeds the carrying value of the net assets of the reporting unit, goodwill is not impaired and no further testing is required. If

the carrying value of the net assets of the reporting unit exceeds the fair value of the reporting unit, then a second step must be performed in order to

determine the implied fair value of the goodwill and compare it to the carrying value of the goodwill. If the carrying value of goodwill exceeds its implied fair

value, then an impairment loss is recorded equal to the difference. US Airways tested its goodwill for impairment during the fourth quarter of 2004, the third

quarter of 2004 (as a result of its Chapter 11 filing), and the fourth quarter of 2003. US Airways concluded in each test that fair value of the reporting unit was

in excess of the carrying value. In the third and fourth quarters of 2004, US Airways' cash flows were prepared on a going-concern basis. Additionally, the

carrying value of US Airways' net assets was less than zero. US Airways assessed the fair value of the reporting unit considering both the income approach

and market approach for 2003. Under the market approach, the fair value of the reporting unit is based on quoted market prices for US Airways Group

common stock and the number of shares outstanding of US Airways Group common stock. Under the income approach, the fair value of the reporting unit is

based on the present value of estimated future cash flows.

Other intangible assets consist primarily of trademark, route authorities and airport take-off and landing slots and airport gates. As of December 31, 2005

and 2004, US Airways had $56 million and $32 million of route authorities on the balance sheets, respectively. The carrying value of trademarks was

$30 million and $33 million as of December 31, 2005 and 2004, respectively. Route authorities and trademarks are classified as indefinite lived assets under

SFAS 142. Indefinite-lived assets are not amortized but instead are reviewed for impairment annually and more frequently if events or circumstances indicate

that the asset may be impaired. Since September 30, 2005, there have been no events or changes that would indicate an impairment to the intangible assets.

US Airways will perform its next annual impairment test on October 1, 2006.218