US Airways 2005 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2005 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

US Airways Group, Inc.

Notes to Consolidated Financial Statements — (Continued)

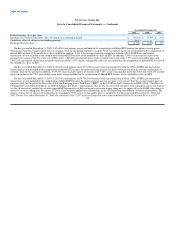

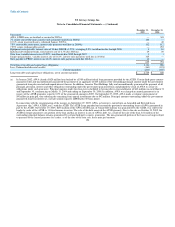

US Airways and AWA are jointly and severally liable for the Airbus loans; accordingly, the full amount outstanding under the loans is reflected in the

financial statements of US Airways and AWA.

The amortization payments under the Airbus $161 million loan will become due in equal quarterly installments of $13 million beginning on March 31,

2008, with the final installment due on December 31, 2010. The outstanding principal amount of Airbus $89 million loan will be forgiven in writing on

December 31, 2010, or an earlier date, if on that date the outstanding principal amount of, accrued interest on, and all other amounts due under the

Airbus $161 million loan have been paid in full and US Airways and AWA comply with the aircraft delivery schedule.

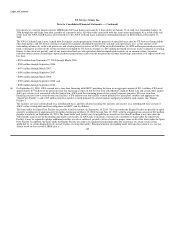

(e) In connection with the consummation of the merger, on September 27, 2005, US Airways, as borrower, entered into the US Airways ATSB Loan with

the ATSB. Also on September 27, 2005, AWA entered into the Amended and Restated AWA Loan Agreement. The ATSB Loans amended and restated

the previously outstanding loans of both US Airways and AWA, each guaranteed in part by the ATSB. On October 19, 2005, $539 million of

US Airways ATSB Loan, of which $525 million was guaranteed by the ATSB, was sold by the lender by order of the ATSB to 13 fixed income

investors. Due to the sale on October 19, 2005, the ATSB no longer guarantees any portion of the loan and has no interest in any of US Airways' debt.

As a result of the sale of the loan, the principal amounts bear interest as a rate per annum equal to LIBOR plus 600 basis points, payable on a quarterly

basis, and are no longer subject to payment of the quarterly guarantee fee. All other terms associated with this loan remain unchanged. As a result of the

sale of the loan, the US Airways ATSB Loan is now referred to as the US Airways Citibank Loan, and had an outstanding balance of $551 million at

December 31, 2005.

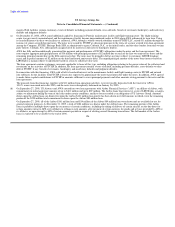

Ninety percent of the US Airways Citibank Loan (Tranche A), the previously guaranteed portion of the loan, was originally funded through a

participating lender's commercial paper conduit program and bears interest at a rate equal to the conduit provider's weighted average cost related to the

issuance of certain commercial paper notes and other short term borrowings plus 0.30%, provided that portions of Tranche A that are held by the

US Airways Citibank Loan or by an assignee and no longer subject to such commercial paper conduit program bear interest at LIBOR plus 40 basis

points, and portions of Tranche A that are under certain circumstances assigned free of the ATSB guarantee bear interest at LIBOR plus 6.0%. Ten

percent of the US Airways Citibank Loan (Tranche B) bears interest at the greater of the Tranche A interest rate plus 6.0% and LIBOR plus 6.0%, as

compared with the previous rate of LIBOR plus 4.0%. The US Airways Citibank loan also reschedules amortization payments for US Airways with

semi-annual payments beginning on March 31, 2007 and continuing through September 30, 2010.

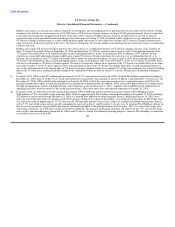

The US Airways Citibank Loan requires certain prepayments from the proceeds of specified asset sales by US Airways Group and the other loan

parties, and US Airways Group is required to maintain consolidated unrestricted cash and cash equivalents, less: (a) the amount of all outstanding

advances by credit card processors and clearing houses in excess of 20% of the air traffic liabilities; (b) $250 million presumed necessary to fund a

subsequent tax trust (to the extent not otherwise funded by US Airways Group); (c) $35 million presumed necessary to post collateral to clearing houses

(to the extent not posted); and (d) any unrestricted cash or cash equivalents held in unperfected accounts; in an amount (subject to partial reduction

under certain circumstances upon mandatory prepayments made with the net proceeds of future borrowings and issuances of capital stock) not less than:

• $525 million from September 27, 2005 through March 2006;

• $500 million through September 2006;

• $475 million through March 2007; 127