US Airways 2005 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2005 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

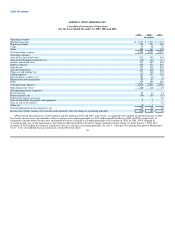

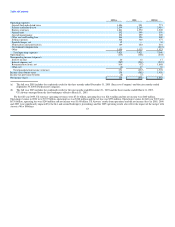

Table of Contents

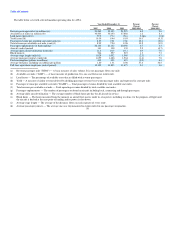

AWA's 2005 results included $75 million of net gains associated with its fuel hedging transactions. This includes $71 million of net realized gains on

settled hedge transactions and $4 million of unrealized gains resulting from the application of mark-to-market accounting for changes in the fair value of fuel

hedging instruments.

The 2005 results include $106 million of special charges, including $13 million of merger related transition expenses, a $27 million loss on the sale and

leaseback of six 737-300 aircraft and two 757 aircraft, $7 million of power by the hour program penalties associated with the return of certain leased aircraft

and a $50 million charge related to an amended Airbus purchase agreement, along with $7 million in capitalized interest. The Airbus restructuring fee was

paid by means of set-off against existing equipment purchase deposits held by Airbus. The 2005 results also included nonoperating expenses of $8 million

related to the write-off of the unamortized value of the ATSB warrants upon their repurchase in October 2005 and an aggregate $2 million write-off of debt

issuance costs associated with the exchange of the 7.25% Senior Exchangeable Notes due 2023 and retirement of a portion of the loan formerly guaranteed by

the ATSB.

AWA's 2004 results include a $16 million net credit associated with the termination of the rate per engine hour agreement with General Electric Engine

Services for overhaul maintenance services on V2500-A1 engines. This credit was partially offset by $2 million of net charges related to the return of certain

Boeing 737-200 aircraft, which includes termination payments of $2 million, the write-down of leasehold improvements and deferred rent of $3 million,

offset by the net reversal of maintenance reserves of $3 million related to the returned aircraft.

The 2004 results also include a $24 million net gain on derivative instruments associated with AWA's fuel hedging program. This amount includes

$26 million of realized gains on settled hedge transactions and $2 million of unrealized losses resulting from mark-to-market accounting for changes in the

fair value of AWA's fuel hedging instruments. A $6 million charge arising from the resolution of pending litigation, a $5 million loss on the sale and

leaseback of two new Airbus aircraft and a $1 million charge for the write-off of debt issuance costs in connection with the refinancing of the term loan were

also recognized in 2004.

AWA's 2003 results include a gain of $81 million related to the federal government assistance received under the Emergency Wartime Supplemental

Appropriations Act and an $11 million net gain on derivative instruments associated with its fuel hedging program. This amount includes $10 million of

realized gains on settled hedge transactions and $1 million of unrealized gains resulting from mark-to-market accounting for changes in the fair value of

AWA's fuel hedging instruments. The 2003 results also include a $10 million nonoperating gain on the sale of AWA's investment in Hotwire.com (see

note 14, "Nonoperating Income (Expenses) — Other, Net" to the consolidated financial statements in Item 8B of this report), an operating gain of $4 million

related to the purchase and subsequent exchange of an A320 airframe and a $3 million operating gain related to the settlement of disputed billings under

AWA's frequent flyer program. These gains were offset in part by $20 million of charges related to the execution of a new labor agreement with ALPA and

net charges of $14 million that resulted from the elimination of AWA's hub operations in Columbus, Ohio ($11 million), the reduction-in-force of certain

management, professional and administrative employees ($2 million) and the impairment of certain owned Boeing 737-200 aircraft that have been grounded

($3 million), offset by a $1 million reduction due to a revision of the estimated costs related to the early termination of certain aircraft leases and a $1 million

reduction related to the revision of estimated costs associated with the sale and leaseback of certain aircraft. See note 5, "Special Charges" to the consolidated

financial statements in Item 8B of this report. 57