US Airways 2005 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2005 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

US Airways Group, Inc.

Notes to Consolidated Financial Statements — (Continued)

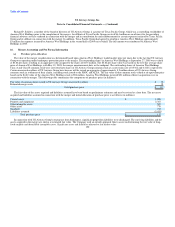

for certain credit enhancements, such as liquidity facilities to cover certain interest payments, that reduce the risks to the purchasers of the trust certificates

and, as a result, reduce the cost of aircraft financings to the Company.

Each trust covered a set amount of aircraft scheduled to be delivered within a specific period of time. At the time of each covered aircraft financing, the

relevant trust used the funds in escrow to purchase equipment notes relating to the financed aircraft. The equipment notes were issued, at AWA or

US Airways' election, either by AWA or US Airways in connection with a mortgage financing of the aircraft or by a separate owner trust in connection with a

leveraged lease financing of the aircraft. In the case of a leveraged lease financing, the owner trust then leased the aircraft to AWA or US Airways. In both

cases, the equipment notes are secured by a security interest in the aircraft. The pass through trust certificates are not direct obligations of, nor are they

guaranteed by, US Airways Group, AWA or US Airways. However, in the case of mortgage financings, the equipment notes issued to the trusts are direct

obligations of AWA and US Airways and in the case of leveraged lease financings, the leases are direct obligations of AWA and US Airways. None of

US Airways Group, AWA or US Airways guarantee or participate in any way in the residual value of the leased aircraft. All of the AWA aircraft financed by

these trusts are currently structured as leveraged lease financings, which are not reflected as debt on the balance sheet of AWA. AWA does not provide

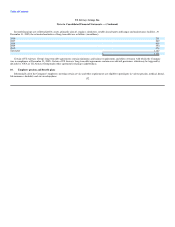

residual value guarantees under these lease arrangements. A portion of the US Airways aircraft financed by these trusts are mortgage financings and as of

December 31, 2005, $652 million is reflected as debt in the accompanying balance sheet.

These leasing entities meet the criteria for variable interest entities. However, they do not meet the consolidation criteria under FIN 46(R) because the

Company is not the primary beneficiary under these arrangements.

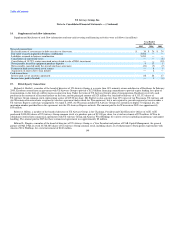

(c) Regional jet capacity purchase agreements

The Company has entered into capacity purchase agreements with certain regional jet operators. The capacity purchase agreements provide that all

revenues (passenger, mail and freight) go to the Company. In return, the Company agrees to pay predetermined fees to the regional airlines for operating an

agreed upon number of aircraft, without regard to the number of passengers onboard. In addition, these agreements provide that certain variable costs, such as

fuel and airport landing fees, will be reimbursed 100% by the Company. The Company controls marketing, scheduling, ticketing, pricing and seat inventories.

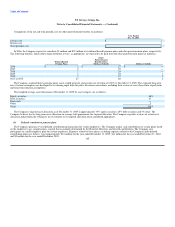

The regional jet capacity purchase agreements have expirations from 2008 to 2015 and provide for optional extensions at the Company's discretion. The

future minimum noncancelable commitments under the regional jet capacity purchase agreements are $1.17 billion in 2006, $1.18 billion in 2007,

$1.21 billion in 2008, $1.23 billion in 2009, $1.26 billion in 2010 and $3.86 billion thereafter.

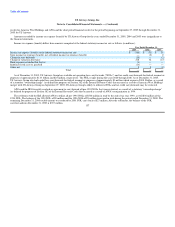

Certain entities with which the Company has capacity purchase agreements are considered variable interest entities under FIN 46(R). In connection with

its restructuring and emergence from bankruptcy, US Airways contracted with Air Wisconsin, a related party, and Republic to purchase a significant portion

of these companies' regional jet capacity for a period of ten years. The Company has determined that it is not the primary beneficiary of these variable interest

entities, based on cash flow analyses. Additionally, other carriers with which US Airways has long-term capacity purchase agreements fall under the business

scope exception of FIN 46(R); therefore, US Airways does not consolidate any of the entities with which it has jet service agreements.

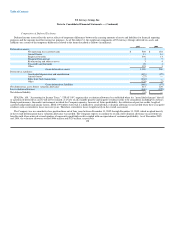

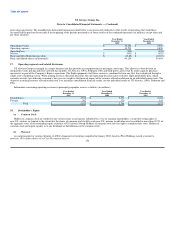

(d) Legal proceedings

On September 12, 2004, US Airways Group and its domestic subsidiaries (the "Debtors") filed voluntary petitions for relief under Chapter 11 of the

Bankruptcy Code in the United States bankruptcy court for the Eastern District of Virginia, Alexandria Division (the "Bankruptcy Court") (Case

142