US Airways 2005 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2005 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

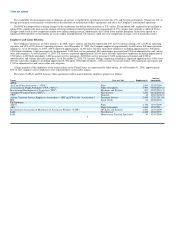

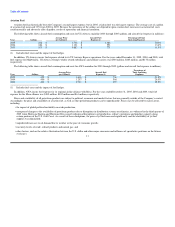

Table of Contents

respectively, associated with termination payments and health care benefits for approximately 2,700 employees participating in these voluntary programs. The

majority of the employees expected to participate in voluntary terminations notified US Airways by March 31, 2005.

In connection with the outsourcing of a portion of its aircraft maintenance and certain fleet service operations, the closing of its Pittsburgh reservation

center, and the closing of certain airport clubs and city ticket offices, US Airways involuntarily terminated or furloughed approximately 2,300 employees. In

the first quarter of 2005, US Airways Group recognized a $44 million charge associated with contractual severance payments and healthcare benefits for those

employees. Notification for the majority of planned involuntary terminations was completed in the first quarter of 2005.

In addition to the cost savings achieved with labor groups, US Airways implemented pay and benefit reductions for its management and other non-union

employees, including reductions to base pay, elimination of jobs and modifications to vacation and sick time accruals. US Airways also reduced the amount it

contributes to its defined contribution retirement plans on behalf of employees and implemented modifications to its postretirement medical benefits and other

retiree benefits. The pay rate and defined contribution plan reductions went into effect October 11, 2004 and the reductions to retiree medical benefits went

into effect March 1, 2005.

Pre-merger US Airways Group also reached agreements with certain of its lessors and lenders to restructure existing aircraft lease and debt financings. On

December 17, 2004, the Bankruptcy Court approved pre-merger US Airways Group's agreements for the continued use and operation of substantially all of its

mainline and Express fleet. Pre-merger US Airways Group reached a comprehensive agreement with General Electric and its affiliates ("GE") on aircraft

leasing and financing and engine services, which provided pre-merger US Airways Group with short-term liquidity, reduced debt, lower aircraft ownership

costs, enhanced engine maintenance services, and operating leases for new regional jets. In June 2005, pre-merger US Airways Group reached an agreement

with GE on the terms and conditions of an agreement that amends and supplements certain provisions of the earlier agreement and provides for additional

agreements regarding rent obligations under aircraft leases and the early redelivery of certain aircraft. The GE agreement was further amended in September

2005 to provide for a cash payment of $125 million by September 30, 2005 in lieu of the issuance of convertible notes to an affiliate of GE as originally

contemplated in the GE agreement. Pre-merger US Airways Group also reached agreements with EMBRAER-Empresa Brasileira de Aeronautica SA and

Bombardier, Inc. providing for continued use and operation of its aircraft, short term liquidity and new financing for regional jets, which were approved by

the Bankruptcy Court in January 2005. Each of these agreements is discussed in detail below in Item 7. "Management's Discussion and Analysis of Financial

Condition and Results of Operations — Liquidity and Capital Resources."

In connection with the merger, US Airways Group and America West Holdings entered into a Memorandum of Understanding with Airbus that includes,

among other things, adjustments to the delivery schedules for narrow-body and wide-body aircraft, a new order for twenty A350 wide-body aircraft for which

Airbus has agreed to provide backstop financing for a substantial number of aircraft, substantial elimination of cancellation penalties on pre-merger

US Airways Group's existing order for ten A330-200 aircraft provided that US Airways Group has met certain predelivery payment obligations under the

A350 order, and a term loan of up to $250 million. The term loan is discussed in more detail below in Item 7. "Management's Discussion and Analysis of

Financial Condition and Results of Operations — Liquidity and Capital Resources."

On September 16, 2005, the Bankruptcy Court issued an order confirming the Debtors' plan of reorganization. The plan of reorganization, which was

based upon the completion of the merger, among other things, set forth a revised capital structure and established the corporate governance for US Airways

Group following the merger and subsequent to emergence from bankruptcy. Under the plan of reorganization, the Debtor's general unsecured creditors

received or will receive approximately 8.2 million shares of the new common stock of US Airways Group, and this represented approximately 10% of

US Airways Group common stock outstanding as of the completion of the merger. The holders of

16