US Airways 2005 Annual Report Download - page 218

Download and view the complete annual report

Please find page 218 of the 2005 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

US Airways, Inc.

Notes to the Financial Statements

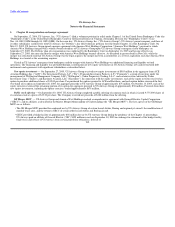

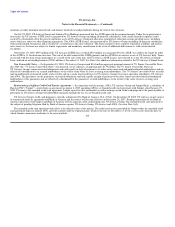

1. Chapter 11 reorganization and merger agreement

On September 12, 2004, US Airways, Inc. ("US Airways") filed a voluntary petition for relief under Chapter 11 of the United States Bankruptcy Code (the

"Bankruptcy Code") in the United States Bankruptcy Court for the Eastern District of Virginia, Alexandria Division (the "Bankruptcy Court") (Case

Nos. 04-13819-SSM through 04-13823-SSM). On the same day, US Airways Group, Inc. ("US Airways Group"), US Airways' parent company, and three of

its other subsidiaries (collectively with US Airways, the "Debtors") also filed voluntary petitions for relief under Chapter 11 of the Bankruptcy Code. On

May 19, 2005, US Airways Group signed a merger agreement with America West Holdings Corporation ("America West Holdings") pursuant to which

America West Holdings merged with a wholly owned subsidiary of US Airways Group upon US Airways Group's emergence from bankruptcy on

September 27, 2005. The Debtors' plan of reorganization was confirmed by the Bankruptcy Court on September 16, 2005 and became effective on

September 27, 2005, the same day that the merger with America West Holdings became effective. As described in greater detail in Note 3(b), while the

merger was structured such that US Airways Group was the legal acquirer, the merger has been accounted for as a reverse acquisition such that America West

Holdings was treated as the accounting acquirer.

Critical to US Airways' emergence from bankruptcy and the merger with America West Holdings was additional financing and liquidity to fund

operations. The financing and liquidity was provided through a combination of new equity investments in US Airways Group, new and restructured debt

instruments and agreements with significant stakeholders as described below.

New equity investments — On September 27, 2005, US Airways Group received new equity investments of $565 million in the aggregate from ACE

Aviation Holdings Inc. ("ACE"); Par Investment Partners, L.P. ("Par"); Peninsula Investment Partners, L.P. ("Peninsula"); a group of investors under the

management of Wellington Management Company, LLP ("Wellington"); Tudor Proprietary Trading, L.L.C. and certain investors advised by Tudor

Investment Corp. ("Tudor"); and Eastshore Aviation, LLC ("Eastshore"). In connection with the equity investments, each of the equity investors received an

option to purchase additional shares at $15.00 per share. Par purchased the options granted to ACE and Eastshore, and each option holder exercised the first

two-thirds of its option on September 28, 2005, for aggregate proceeds to US Airways Group of approximately $75 million. On October 13, 2005, each of the

equity investors exercised the remaining portion of its option for aggregate proceeds to US Airways Group of approximately $38 million. Proceeds from these

new equity investments, including the option exercises, totaled approximately $678 million.

Public stock offering — On September 30, 2005, US Airways Group completed a public offering of common stock in which it issued 9,775,000 shares of

its common stock at a price of $19.30 per share. The Company received net proceeds of $180 million from the offering.

GE Merger MOU — US Airways Group and America West Holdings reached a comprehensive agreement with General Electric Capital Corporation

("GECC"), and its affiliates as described in the Master Merger Memorandum of Understanding (the "GE Merger MOU"). The key aspects of the GE Merger

MOU are as follows:

• The GE Merger MOU provided for continued use by US Airways Group of certain leased Airbus, Boeing and regional jet aircraft, the modification of

monthly lease rates, and the return to GECC of certain other leased Airbus and Boeing aircraft.

• GECC provided a bridge facility of approximately $56 million for use by US Airways Group during the pendency of the Chapter 11 proceedings.

US Airways paid an affiliate of General Electric ("GE") $125 million in cash on September 30, 2005 in exchange for retirement of the bridge facility,

forgiveness and release of US Airways from certain prepetition obligations, deferral of

212