US Airways 2005 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2005 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

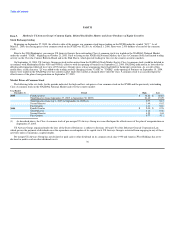

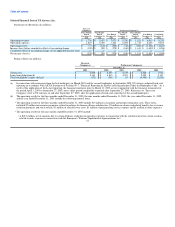

Airbus. US Airways recorded its restructuring fee of $39 million as a reorganization item in the third quarter of 2005. The America West Holdings

restructuring fee of $50 million was recorded as a special charge in the accompanying consolidated statement of operations, along with $7 million in

related capitalized interest.

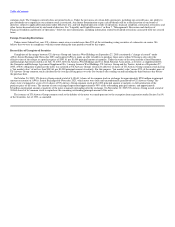

Restructuring of the ATSB Loan Guarantees — US Airways Group and America West Holdings each had loans outstanding guaranteed under the Air

Transportation Safety and System Stabilization Act by the ATSB. In connection with the September 12, 2004 Chapter 11 filing, the ATSB and the lenders

under the US Airways ATSB loan agreed to authorize US Airways Group to continue to use cash collateral securing the US Airways ATSB loan on an

interim basis, which we refer to as the cash collateral agreement. US Airways reached agreements with the ATSB concerning interim extensions to the cash

collateral agreement, the last of which was extended to the earlier of the effective date of the plan of reorganization or October 25, 2005. The cash collateral

agreement and subsequent extensions each required US Airways Group, among other conditions, to maintain a weekly minimum unrestricted cash balance

which decreased periodically during the term of the extension.

On July 22, 2005, US Airways Group and America West Holdings announced that the ATSB approved the proposed merger. Under the negotiated new

loan terms, the US Airways loan is guaranteed by US Airways Group (including all domestic subsidiaries, with certain limited exceptions) and is secured by

substantially all of the present and future assets of US Airways Group not otherwise encumbered, other than certain specified assets, including assets which

are subject to other financing agreements. The AWA loan is also guaranteed by US Airways Group (including all domestic subsidiaries, with certain limited

exceptions) and is secured by a second lien in the same collateral. The loans continue to have separate repayment schedules and interest rates; however, the

loans are subject to similar repayments and mandatory amortization in the event of additional debt issuances, with certain limited exceptions.

On October 19, 2005, $777 million of the loans, of which $752 million was guaranteed by the ATSB, was sold by the lenders by order of the ATSB to 13

fixed income investors. The sale of the debt removed the ATSB guaranty, and the ATSB no longer has an interest in any of the Company's debt. The total

outstanding balance of the loans as of December 31, 2005 was $801 million, of which $551 million is outstanding under the US Airways loan and

$250 million is outstanding under the AWA loan. Terms associated with these loans remain unchanged, with the AWA loan terminating in 2008 and the

US Airways loan terminating in 2010.

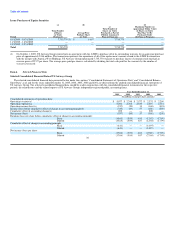

The US Airways loan bears interest as follows:

• 90% of the US Airways loan (Tranche A), which was the portion of the loan previously guaranteed by the ATSB, was originally funded through a

participating lender's commercial paper conduit program and bears interest at a rate equal to the conduit provider's weighted average cost related to the

issuance of certain commercial paper notes and other short term borrowings plus 0.30%, provided that portions of Tranche A that were held by the

ATSB or are held by an assignee and are no longer subject to such commercial paper conduit program bear interest at LIBOR plus 40 basis points, and

portions of Tranche A that are under certain circumstances assigned free of the ATSB guarantee bear interest at LIBOR plus 6.0%; and

• 10% of the US Airways loan (Tranche B) bears interest at the greater of the Tranche A interest rate plus 6.0% and LIBOR plus 6.0% from a prior rate

of LIBOR plus 4.0%.

The US Airways loan also reschedules amortization payments for US Airways with semi-annual payments beginning on March 31, 2007, and continuing

through September 30, 2010.

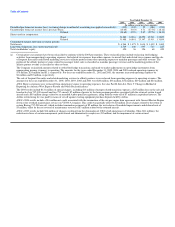

US Airways was required to pay down the principal of its loan with the first $125 million of net proceeds from specified asset sales identified in

connection with its Chapter 11 proceedings, whether completed before or after emergence from bankruptcy. US Airways then retains the next $83 million of

net proceeds from specified asset sales, and must prepay the principal of loan with 60% of net proceeds in excess of an aggregate of $208 million from

specified asset sales. Any such asset sales proceeds up to $275 million are to be applied in order of maturity, and any such asset sales proceeds in excess of

46