US Airways 2005 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2005 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

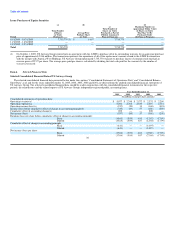

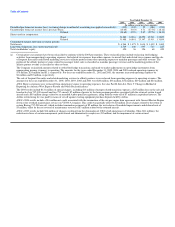

September 28, 2005, for aggregate proceeds to US Airways Group of approximately $75 million. On October 13, 2005, each of the equity investors exercised

the remaining portion of its option for aggregate proceeds to US Airways Group of approximately $38 million. Proceeds from these new equity investments,

including the option exercises, totaled approximately $678 million.

Public Stock Offering — On September 30, 2005, US Airways Group completed a public offering of common stock in which it issued 9,775,000 shares of

its common stock at a price of $19.30 per share. The Company received net proceeds of $180 million from the offering.

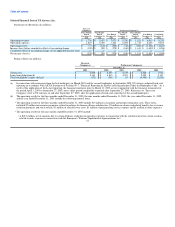

GE Merger MOU — US Airways Group and America West Holdings reached a comprehensive agreement with GECC and its affiliates as described in the

Master Merger Memorandum of Understanding (the "GE Merger MOU"). The key aspects of the GE Merger MOU are as follows:

• Continued use by US Airways Group of certain leased Airbus, Boeing and regional jet aircraft, the modification of monthly lease rates, and the return to

GECC of certain other leased Airbus and Boeing aircraft.

• GECC provided a bridge facility of approximately $56 million for use by US Airways Group during the pendency of the Chapter 11 proceedings.

US Airways paid an affiliate of GE $125 million in cash on September 30, 2005 in exchange for retirement of the bridge facility, forgiveness and

release of US Airways from certain prepetition obligations, deferral of certain payment obligations and amendments to maintenance agreements. The

payment was funded through the issuance of 7% Senior Convertible Notes due 2020 on September 30, 2005, as discussed in more detail below.

• In June 2005, GECC purchased and immediately leased back to US Airways Group: (a) the assets securing the credit facility obtained from GE in 2001

and the liquidity facility obtained from GE in 2003 in connection with US Airways Group's emergence from the first bankruptcy, and other GE

obligations, consisting of 11 Airbus aircraft and 28 spare engines and engine stands; and (b) ten regional jet aircraft previously debt-financed by GECC.

The proceeds from the sale leaseback transaction of approximately $633 million were used to pay down balances due to GE by US Airways Group

under the 2003 GE liquidity facility in full, the GECC mortgage-debt financed CRJ aircraft in full, and a portion of the 2001 GE credit facility. The

2001 GE credit facility was amended to allow certain additional borrowings up to $28 million.

Airbus MOU — In connection with the merger, a Memorandum of Understanding was executed between AVSA S.A.R.L., an affiliate of Airbus S.A.S.

("Airbus"), US Airways Group, US Airways and AWA. The key aspects of the Airbus Memorandum of Understanding are as follows:

• On September 27, 2005, US Airways and AWA entered into two loan agreements with Airbus Financial Services, as Initial Lender and Loan Agent,

Wells Fargo Bank Northwest, National Association, as Collateral Agent, and US Airways Group, as guarantor, with commitments in initial aggregate

amounts of up to $161 million and up to $89 million. The Airbus loans bear interest at a rate of LIBOR plus a margin, subject to adjustment. In each of

the separate financial statements of US Airways and AWA, the Airbus loan has also been presented as a liability, as each entity is jointly and severally

liable for this obligation.

• Airbus rescheduled US Airways Group's A320-family and A330-200 delivery commitments and has agreed to provide backstop financing for a

substantial number of aircraft, subject to certain terms and conditions, on an order of 20 A350 aircraft. US Airways Group's A320-family aircraft are

now scheduled for delivery in 2009 and 2010. US Airways Group's A330-200 aircraft are scheduled for delivery in 2009 and 2010 and A350 aircraft

deliveries are currently scheduled to occur beginning in 2011. The Airbus Memorandum of Understanding also eliminates cancellation penalties on

US Airways Group's orders for the ten A330-200 aircraft, provided that US Airways Group has met certain predelivery payment obligations under the

A350 order. In connection with the restructuring of aircraft firm orders, US Airways Group and America West Holdings were required to pay an

aggregate non-refundable restructuring fee which was paid by means of set- off against existing equipment purchase deposits of US Airways Group and

America West Holdings held by 45