US Airways 2005 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2005 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

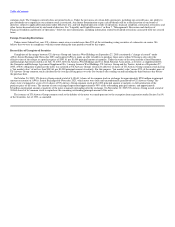

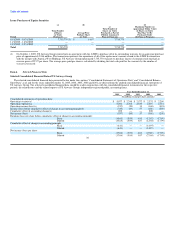

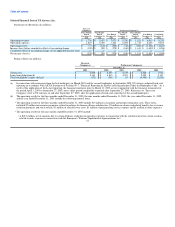

Table of Contents

• A $35 million charge in connection with US Airways' intention not to take delivery of certain aircraft scheduled for future delivery.

• The results for the year ended December 31, 2002 include:

• A $392 million impairment charge as a result of an impairment analysis conducted on the B737-300, B737-400, B757-200 and B767-200 aircraft

fleets as a result of changes to the aircraft's recoverability periods, the planned conversion of owned aircraft to leased aircraft and indications of

possible material changes to the market values of these aircraft. The analysis revealed that estimated undiscounted future cash flows generated by

these aircraft were less than their carrying values for four B737-300s, 15 B737-400s, 21 B757-200s and three B767-200s. In accordance with

Statement of Financial Accounting Standards No. 144, "Accounting for the Impairment or Disposal of Long-Lived Assets," the carrying values were

reduced to fair market value.

• A curtailment credit of $120 million related to certain postretirement benefit plans and a $30 million curtailment charge related to certain defined

benefit pension plans.

• An impairment charge of $21 million related to capitalized gates at certain airports in accordance with Statement of Financial Accounting Standards

No. 142, "Goodwill and Other Intangible Assets." The carrying values of the affected gates were reduced to fair value based on a third-party

appraisal.

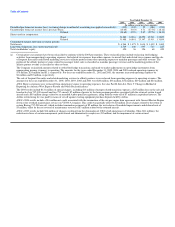

• The results for the year ended December 31, 2001 include:

• An aircraft impairment and related charge of $787 million. During August 2001, US Airways conducted an impairment analysis in accordance with

Statement of Financial Accounting Standards No. 121 "Accounting for the Impairment of Long-Lived Assets and for Long-Lived Assets to Be

Disposed Of" ("SFAS 121") on its 36 F-100 aircraft, 16 MD-80 aircraft and 39 B737-200 aircraft as a result of changes to the fleet plan as well as

indications of possible material changes to the market values of these aircraft. The analysis revealed that estimated undiscounted future cash flows

generated by these aircraft were less than their carrying values. In accordance with SFAS 121, the carrying values were reduced to fair market value.

This analysis resulted in a pretax charge of $403 million. In the aftermath of September 11, 2001, US Airways elected to accelerate the retirement of

the aforementioned aircraft. All B737-200 aircraft retirements were accelerated to the end of 2001 while the F-100s and MD-80s were scheduled to

be retired by April 2002. Based on this, US Airways conducted another impairment analysis which revealed that these aircraft were impaired. This

culminated in an additional pretax charge of $173 million largely reflecting the further diminution in value of used aircraft arising from the events of

September 11, 2001. Management estimated fair market value using third-party appraisals, published sources and recent sales and leasing

transactions. As a result of the events of September 11, 2001, US Airways reviewed other aircraft-related assets which resulted in a pretax charge of

$15 million as certain aircraft assets had carrying values in excess of their fair value less costs to sell. Management estimated fair value based on

recent sales and leasing transactions. US Airways also recognized a pretax charge of $26 million in connection with the write-down to lower of cost

or market of surplus parts for the F-100, B737-200 and MD-80 fleets. Management estimated market value based on recent sales activity related to

these parts. During the first quarter of 2002, US Airways entered into agreements to sell 97 surplus aircraft and related spare engines and parts,

including substantially all its DC-9, MD-80 and B737-200 aircraft. In connection with these agreements, US Airways reduced the carrying values of

these assets resulting in a $148 million charge during the fourth quarter of 2001, including a $138 million impairment charge and a charge of

$10 million to write down the related spare parts. Additionally, US Airways recognized a pretax impairment charge of $22 million in connection

with the planned retirement of five B737-200 aircraft due to a third-party's early return of certain leased B737-200 aircraft, and early retirement of

certain other B737-200s during the first quarter of 2001. 42