Travelers 2015 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2015 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

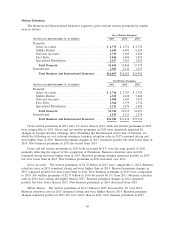

In 2015, gross and net Agency written premiums were both 3% higher than in 2014. In 2014, gross

and net Agency written premiums were 4% and 1% lower, respectively, than in 2013. The higher rate

of decrease in gross written premiums in 2014 was primarily driven by the impact of the sale of the

Company’s NFIP business in 2013 described above.

In 2015, net written premiums in the Agency Automobile line of business were 8% higher than in

2014. Business retention rates in 2015 remained strong and were higher than in 2014. Renewal

premium changes in 2015 remained positive but were lower than in 2014. New business premiums in

2015 increased over 2014 driven by sales of the Company’s private passenger automobile product,

Quantum Auto 2.0. In 2014, net written premiums in the Agency Automobile line of business were

slightly higher than in 2013. Business retention rates remained strong in 2014 and were higher than in

2013. Renewal premium changes in 2014 remained positive but were lower than in 2013. New business

premiums in 2014 were significantly higher than in 2013 as a result of Quantum Auto 2.0.

In 2015, net written premiums in the Agency Homeowners and Other line of business were 1%

lower than in 2014. Business retention rates in 2015 remained strong and were higher than in 2014.

Renewal premium changes in 2015 remained positive but were lower than in 2014. New business

premiums in 2015 increased over 2014. In 2014, net written premiums in the Agency Homeowners and

Other line of business were 2% lower than 2013. Business retention rates remained strong in 2014 and

were higher than in 2013. Renewal premium changes in 2014 remained positive but were lower than in

2013. New business premiums in 2014 were higher than in 2013.

For its Agency business, the Personal Insurance segment had approximately 6.2 million and

6.0 million active policies at December 31, 2015 and 2014, respectively.

Direct to Consumer Written Premiums

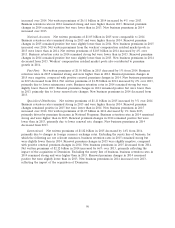

In the direct to consumer business, net written premiums in 2015 were $236 million, $49 million or

26% higher than in 2014. In 2015, automobile net written premiums increased by $36 million or 28%

over 2014, and homeowners and other net written premiums increased by $13 million or 23% over

2014. Net written premiums in 2014 were $187 million, $25 million or 15% higher than in 2013. In

2014, automobile net written premiums increased by $18 million or 16% over 2013, and homeowners

and other net written premiums increased by $7 million or 14% over 2013. The direct to consumer

business had 242,000 and 193,000 active policies at December 31, 2015 and 2014, respectively.

Interest Expense and Other

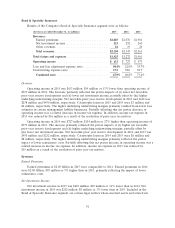

(for the year ended December 31, in millions) 2015 2014 2013

Operating loss .................................. $(255) $(257) $(248)

The operating loss in 2015 was $2 million lower than in 2014. The operating loss in 2014 was

$9 million higher than in 2013. After-tax interest expense in 2015, 2014 and 2013 was $242 million,

$240 million and $235 million, respectively. The increase in interest expense in both 2015 and 2014

compared with the respective prior years primarily reflected slightly higher average levels of debt

outstanding.

ASBESTOS CLAIMS AND LITIGATION

The Company believes that the property and casualty insurance industry has suffered from court

decisions and other trends that have expanded insurance coverage for asbestos claims far beyond the

original intent of insurers and policyholders. The Company has received and continues to receive a

significant number of asbestos claims from the Company’s policyholders (which includes others seeking

coverage under a policy). Factors underlying these claim filings include continued intensive advertising

97