Travelers 2015 Annual Report Download - page 120

Download and view the complete annual report

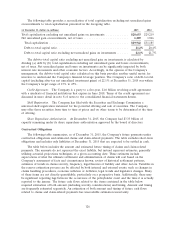

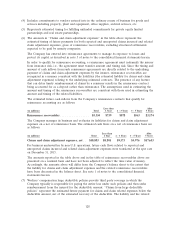

Please find page 120 of the 2015 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.adjustment expense reserves, or if changes in the estimated level of claims and claim adjustment

expense reserves are necessary, our financial results could be materially and adversely affected’’ herein.

In Business and International Insurance, the Company expects underlying underwriting margins in

2016 will be broadly consistent with those in 2015, reflecting lower (and more normalized) levels of

what the Company defines as large losses and non-catastrophe weather-related losses.

In Bond & Specialty Insurance, the Company expects underlying underwriting margins in 2016 will

be broadly consistent with those in 2015.

In Personal Insurance, the Company expects underlying underwriting margins in 2016 will be lower

than in 2015. In Agency Automobile, the Company expects underlying underwriting margins in 2016

will be slightly lower than in 2015, reflecting a higher mix of new business versus renewal business. In

Agency Homeowners and Other, the Company expects underlying underwriting margins in 2016 will be

lower than in 2015, reflecting higher (and more normalized) levels of loss activity. Also in Personal

Insurance, the Company’s direct to consumer initiative, the distribution channel that the Company

launched in 2009, while intended to enhance the Company’s long-term ability to compete successfully in

a consumer-driven marketplace, is expected to remain modest with respect to premium volume and

remain unprofitable for a number of years as this book of business grows and matures.

Consolidation within the insurance industry, including among insurance companies, reinsurance

companies and brokers and independent insurance agencies, could alter the competitive environment in

which the Company operates, positively or negatively, which may impact the Company’s premium

volume, the rate it can charge for its products, and the terms on which its products are offered.

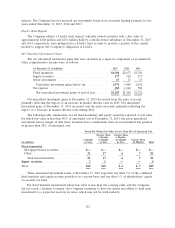

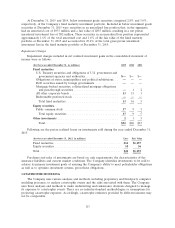

Investment Portfolio. The Company expects to continue to focus its investment strategy on

maintaining a high-quality investment portfolio and a relatively short average effective duration. The

average effective duration of fixed maturities and short-term securities was 3.9 (4.2 excluding short-term

securities) at December 31, 2015. From time to time, the Company enters into short positions in U.S.

Treasury futures contracts to manage the duration of its fixed maturity portfolio. At December 31,

2015, the Company had $400 million notional value of open U.S. Treasury futures contracts. The

Company continually evaluates its investment alternatives and mix. Currently, the majority of the

Company’s investments are comprised of a widely diversified portfolio of high-quality, liquid, taxable

U.S. government, tax-exempt U.S. municipal and taxable corporate and U.S. agency mortgage-backed

bonds.

The Company also invests much smaller amounts in equity securities, real estate, private equity

limited partnerships, hedge funds, and real estate partnerships and joint ventures. These investment

classes have the potential for higher returns but also the potential for higher degrees of risk, including

less stable rates of return and less liquidity.

Net investment income is a material contributor to the Company’s results of operations. Interest

rates remain at very low levels by historical standards. Based on the current interest rate environment,

the Company estimates that the impacts of lower reinvestment yields and a lower level of fixed

maturity investments could, in 2016, result in approximately $25 million to $30 million of lower

after-tax net investment income from that portfolio on a quarterly basis as compared to the

corresponding periods of 2015. Net investment income from the non-fixed maturity investment portfolio

in 2015 was lower than in 2014. Particularly given the recent levels of market volatility, there is more

than the usual uncertainty as to the impact of future market conditions on net investment income from

the non-fixed maturity investment portfolio in 2016. If general economic conditions and/or investment

market conditions deteriorate during 2016, the Company could experience a further reduction in net

investment income and/or significant realized investment losses, including impairments.

The Company had a net pretax unrealized investment gain of $1.78 billion ($1.16 billion after-tax)

in its fixed maturity investment portfolio at December 31, 2015. While the Company does not attempt

to predict future interest rate movements, a rising interest rate environment would reduce the market

120