Travelers 2015 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2015 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.LIQUIDITY AND CAPITAL RESOURCES

Liquidity is a measure of a company’s ability to generate sufficient cash flows to meet the cash

requirements of its business operations and to satisfy general corporate purposes when needed.

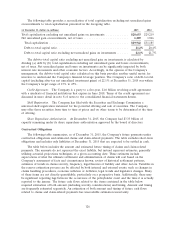

Operating Company Liquidity. The liquidity requirements of the Company’s insurance subsidiaries

are met primarily by funds generated from premiums, fees, income received on investments and

investment maturities. Cash provided from these sources is used primarily for claims and claim

adjustment expense payments and operating expenses. The insurance subsidiaries’ liquidity

requirements can be impacted by, among other factors, the timing and amount of catastrophe claims,

which are inherently unpredictable, as well as the timing and amount of reinsurance recoveries, which

may be affected by reinsurer solvency and reinsurance coverage disputes. Additionally, the variability of

asbestos-related claim payments, as well as the volatility of potential judgments and settlements arising

out of litigation, may also result in increased liquidity requirements. It is the opinion of the Company’s

management that the insurance subsidiaries’ future liquidity needs will be adequately met from all of

the sources described above. Subject to restrictions imposed by states in which the Company’s insurance

subsidiaries are domiciled, the Company’s principal insurance subsidiaries pay dividends to their

respective parent companies, which in turn pay dividends to the corporate holding (parent) company

(TRV). For further information regarding restrictions on dividends paid by the Company’s insurance

subsidiaries, see ‘‘Part I—Item 1—Regulation’’ herein.

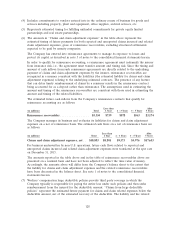

Holding Company Liquidity. TRV’s liquidity requirements primarily include shareholder dividends,

debt servicing, common share repurchases and, from time to time, contributions to its qualified

domestic pension plan. At December 31, 2015, TRV held total cash and short-term invested assets in

the United States aggregating $1.63 billion and having a weighted average maturity of 66 days. It is the

opinion of the Company’s management that these assets, which are in excess of TRV’s target level,

comprising TRV’s estimated annual pretax interest expense and common shareholders dividends, and

currently totals approximately $1.1 billion, are sufficient to meet TRV’s current liquidity requirements.

TRV is not dependent on dividends or other forms of repatriation from its foreign operations to

support its liquidity needs. U.S. income taxes have not been recognized on $383 million of the

Company’s foreign operations’ undistributed earnings as of December 31, 2015, as such earnings are

intended to be permanently reinvested in those operations. Furthermore, taxes paid to foreign

governments on these earnings may be used as credits against the U.S. tax on dividend distributions if

such earnings were to be distributed to the holding company. The amount of undistributed earnings

from foreign operations and related taxes on those undistributed earnings were not material to the

Company’s financial position or liquidity at December 31, 2015.

TRV has a shelf registration statement filed with the Securities and Exchange Commission which

permits it to issue securities from time to time. TRV also has a $1.0 billion line of credit facility with a

syndicate of financial institutions that expires in June 2018. This line of credit also supports TRV’s

$800 million commercial paper program, of which $100 million was outstanding at December 31, 2015.

TRV is not reliant on its commercial paper program to meet its operating cash flow needs.

The Company utilized uncollateralized letters of credit issued by major banks with an aggregate

limit of approximately $197 million, to provide a portion of the capital needed to support its obligations

at Lloyd’s at December 31, 2015. If uncollateralized letters of credit are not available at a reasonable

price or at all in the future, the Company can collateralize these letters of credit or may have to seek

alternative means of supporting its obligations at Lloyd’s, which could include utilizing holding company

funds on hand.

On June 20, 2016, the Company’s $400 million, 6.25% senior notes will mature. The Company may

refinance this maturing debt through funds generated internally or, depending on market conditions,

through funds generated externally.

122