Travelers 2015 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2015 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

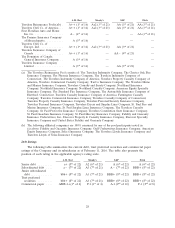

The gross and net cumulative redundancy by calendar year as set forth in the table above includes

the following impact of unfavorable prior year reserve development related to asbestos and

environmental claims and claim adjustment expenses, in millions:

Asbestos 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

Gross ................................. $1,840 $1,643 $1,644 $1,574 $1,389 $1,127 $932 $761 $571 $313

Net.................................. $1,565 $1,409 $1,409 $1,339 $1,154 $1,014 $839 $664 $474 $224

Environmental 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

Gross ................................. $ 931 $ 823 $ 641 $ 556 $ 471 $ 426 $346 $247 $175 $ 81

Net.................................. $ 885 $ 765 $ 580 $ 495 $ 425 $ 390 $314 $224 $159 $ 72

Reserves on Statutory Accounting Basis

At December 31, 2015, 2014 and 2013, claims and claim adjustment expense reserves (net of

reinsurance) shown in the preceding table, which are prepared in accordance with U.S. generally

accepted accounting principles (GAAP reserves), were $41 million higher, $29 million higher and

$17 million higher respectively, than those reported in the Company’s respective annual reports filed

with insurance regulators, which are prepared in accordance with statutory accounting practices

(statutory reserves).

The differences between GAAP and statutory reserves are primarily due to the differences in

GAAP and statutory accounting for two items: (1) fees associated with billing of required

reimbursements under large deductible business, and (2) the accounting for retroactive reinsurance. For

large deductible business, the Company pays the deductible portion of a casualty insurance claim and

then seeks reimbursement from the insured, plus a fee. This fee is reported as fee income for GAAP

reporting, but as an offset to claim expenses paid for statutory reporting. Retroactive reinsurance

balances result from reinsurance placed to cover losses on insured events occurring prior to the

inception of a reinsurance contract. For GAAP reporting, retroactive reinsurance balances are included

in reinsurance recoverables and result in lower net reserve amounts. Statutory accounting practices

require retroactive reinsurance balances to be recorded in other liabilities as contra-liabilities rather

than in loss reserves.

Asbestos and Environmental Claims

Asbestos and environmental claims are segregated from other claims and are handled separately by

the Company’s Special Liability Group, a separate unit staffed by dedicated legal, claim, finance and

engineering professionals. For additional information on asbestos and environmental claims, see

‘‘Item 7—Management’s Discussion and Analysis of Financial Condition and Results of Operations—

Asbestos Claims and Litigation’’ and ‘‘—Environmental Claims and Litigation.’’

INTERCOMPANY REINSURANCE POOLING ARRANGEMENTS

Most of the Company’s domestic insurance subsidiaries are members of an intercompany property

and casualty reinsurance pooling arrangement. Pooling arrangements permit the participating

companies to rely on the capacity of the entire pool’s statutory capital and surplus rather than just on

its own statutory capital and surplus. Under such arrangements, the members share substantially all

insurance business that is written and allocate the combined premiums, losses and expenses.

RATINGS

Ratings are an important factor in assessing the Company’s competitive position in the insurance

industry. The Company receives ratings from the following major rating agencies: A.M. Best Company

(A.M. Best), Fitch Ratings (Fitch), Moody’s Investors Service (Moody’s) and Standard & Poor’s Corp.

26