Travelers 2015 Annual Report Download - page 242

Download and view the complete annual report

Please find page 242 of the 2015 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

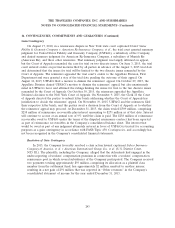

16. CONTINGENCIES, COMMITMENTS AND GUARANTEES (Continued)

former policyholder Johns-Manville Corporation on the ground that the suits violated injunctions

entered in connection with confirmation of the Johns-Manville bankruptcy (the 1986 Orders). The

bankruptcy court issued a temporary restraining order and referred the parties to mediation. In

November 2003, the parties reached a settlement of the Statutory and Hawaii Actions, which

included a lump-sum payment of up to $412 million by TPC, subject to a number of significant

contingencies. In May 2004, the parties reached a settlement resolving substantially all pending and

similar future Common Law Claims against TPC, which included a payment of up to $90 million

by TPC, subject to similar contingencies.

After the parties reached the settlements of the Statutory and Hawaiian Actions and the

Common Law Claims (collectively ‘‘the Settlements’’), numerous proceedings took place in the

bankruptcy, district and appellate courts concerning the approval of the Settlements and their

effect on other parties. As a result of certain rulings in those proceedings, TPC concluded that it

was not obligated to go forward with the Settlements because certain conditions precedent to the

Settlements had not been met.

The plaintiffs in the Statutory and Hawaii Actions and the Common Law Claims actions

thereafter filed motions in the bankruptcy court to compel TPC to make payment under the

settlement agreements, arguing that all conditions precedent to the Settlements had been met. On

December 16, 2010, the bankruptcy court granted the plaintiffs’ motions and ruled that TPC was

required to fund the Settlements. The court entered judgment against TPC on January 20, 2011 in

accordance with this ruling and ordered TPC to pay the Settlements plus prejudgment interest.

The bankruptcy court’s judgment was reversed by the district court on March 1, 2012, the district

court having found that the conditions to the Settlements had not been met. The plaintiffs

appealed the district court’s March 1, 2012 decision to the Second Circuit Court of Appeals. On

July 22, 2014, the Second Circuit issued an opinion reversing the district court’s decision and

reinstating the bankruptcy court’s January 20, 2011 order which ordered TPC to pay the

Settlements plus prejudgment interest. On August 5, 2014, TPC filed a Petition for Rehearing and

Rehearing En Banc with the Second Circuit, which was denied on January 5, 2015. On January 15,

2015, the bankruptcy court entered an order directing TPC to pay $579 million to the plaintiffs,

comprising the $502 million settlement amount described above, plus pre-judgment and

post-judgment interest totaling $77 million, and the Company made that payment in January 2015.

The payment was fully accrued in the Company’s financial statements at December 31, 2014.

Other Proceedings Not Arising Under Insurance Contracts or Reinsurance Agreements

The Company is involved in other lawsuits, including lawsuits alleging extra-contractual damages

relating to insurance contracts or reinsurance agreements, that do not arise under insurance contracts

or reinsurance agreements. The legal costs associated with such lawsuits are expensed in the period in

which the costs are incurred. Based upon currently available information, the Company does not

believe it is reasonably possible that any such lawsuit or related lawsuits would be material to the

Company’s results of operations or would have a material adverse effect on the Company’s financial

position or liquidity.

242