Travelers 2015 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2015 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

liquidity, and could adversely impact our ratings, our ability to raise capital and the availability

and cost of reinsurance’’ and ‘‘—Outlook—Underwriting Gain/Loss.’’

• Changing climate conditions could also impact the creditworthiness of issuers of securities in

which the Company invests. For example, water supply adequacy could impact the

creditworthiness of bond issuers in the Southwestern United States, and more frequent and/or

severe hurricanes could impact the creditworthiness of issuers in the Southeastern United States,

among other areas. See ‘‘Risk Factors—Our investment portfolio may suffer reduced returns or

material realized or unrealized losses.’’

• Increased regulation adopted in response to potential changes in climate conditions may impact

the Company and its customers. For example, state insurance regulation could impact the

Company’s ability to manage property exposures in areas vulnerable to significant climate driven

losses. If the Company is unable to implement risk based pricing, modify policy terms or reduce

exposures to the extent necessary to address rising losses related to catastrophes and smaller

scale weather events (should those increased losses occur), its business may be adversely

affected. See ‘‘Risk Factors—Catastrophe losses could materially and adversely affect our results

of operations, our financial position and/or liquidity, and could adversely impact our ratings, our

ability to raise capital and the availability and cost of reinsurance.’’

• The full range of potential liability exposures related to climate change continues to evolve.

Through the Company’s Emerging Issues Committee and its Committee on Climate, Energy and

the Environment, the Company works with its business units and corporate groups, as

appropriate, to identify and try to assess climate change-related liability issues, which are

continually evolving and often hard to fully evaluate. See ‘‘Risk Factors—The effects of

emerging claim and coverage issues on our business are uncertain.’’

Climate change regulation also could increase the Company’s customers’ costs of doing business.

For example, insureds faced with carbon management regulatory requirements may have less available

capital for investment in loss prevention and safety features which may, over time, increase loss

exposures. Also, increased regulation may result in reduced economic activity, which would decrease

the amount of insurable assets and businesses.

The Company regularly reviews emerging issues, such as changing climate conditions, to consider

potential changes to its modeling and the use of such modeling, as well as to help determine the need

for new underwriting strategies, coverage modifications or new products.

REINSURANCE RECOVERABLES

The Company reinsures a portion of the risks it underwrites in order to control its exposure to

losses. For additional discussion regarding the Company’s reinsurance coverage, see ‘‘Part I—Item 1—

Reinsurance.’’

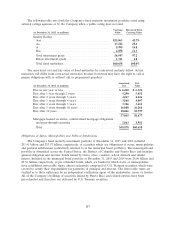

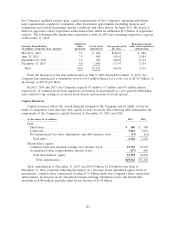

The following table summarizes the composition of the Company’s reinsurance recoverables:

(at December 31, in millions) 2015 2014

Gross reinsurance recoverables on paid and unpaid claims and

claim adjustment expenses ............................ $3,848 $4,270

Allowance for uncollectible reinsurance ..................... (157) (203)

Net reinsurance recoverables ............................ 3,691 4,067

Mandatory pools and associations ......................... 2,015 1,909

Structured settlements ................................. 3,204 3,284

Total reinsurance recoverables ........................... $8,910 $9,260

116