Travelers 2015 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2015 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

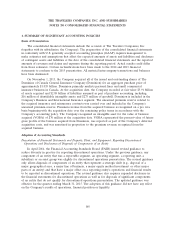

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Other Accounting Standards Not Yet Adopted

Revenue from Contracts with Customers

In May 2014, the FASB issued updated guidance to clarify the principles for recognizing revenue.

While insurance contracts are not within the scope of this updated guidance, the Company’s fee income

related to providing claims and policy management services as well as claim and loss prevention

services will be subject to this updated guidance.

The updated guidance requires an entity to recognize revenue as performance obligations are met,

in order to reflect the transfer of promised goods or services to customers in an amount that reflects

the consideration the entity is entitled to receive for those goods or services. The following steps are

applied in the updated guidance: (1) identify the contract(s) with a customer; (2) identify the

performance obligations in the contract; (3) determine the transaction price; (4) allocate the transaction

price to the performance obligations in the contract; and (5) recognize revenue when, or as, the entity

satisfies a performance obligation.

In July 2015, the FASB deferred the effective date of the updated guidance by one year. The

updated guidance is effective for the quarter ending March 31, 2018. The adoption of this guidance is

not expected to have a material effect on the Company’s results of operations, financial position or

liquidity.

Compensation—Stock Compensation: Accounting for Share-Based Payments When the Terms of an Award

Provide That a Performance Target Could Be Achieved after the Requisite Service Period

In June 2014, the FASB issued updated guidance to resolve diversity in practice concerning

employee share-based payments that contain performance targets that could be achieved after the

requisite service period. Many reporting entities account for performance targets that could be achieved

after the requisite service period as performance conditions that affect the vesting of the award and,

therefore, do not reflect the performance targets in the estimate of the grant-date fair value of the

award. Other reporting entities treat those performance targets as nonvesting conditions that affect the

grant-date fair value of the award.

The updated guidance requires that a performance target that affects vesting and that can be

achieved after the requisite service period be treated as a performance condition. As such, the

performance target that affects vesting should not be reflected in estimating the fair value of the award

at the grant date. Compensation cost should be recognized in the period in which it becomes probable

that the performance target will be achieved and should represent the compensation cost attributable to

the periods for which service has been rendered. If the performance target becomes probable of being

achieved before the end of the service period, the remaining unrecognized compensation cost for which

requisite service has not yet been rendered is recognized prospectively over the remaining service

period. The total amount of compensation cost recognized during and after the service period should

reflect the number of awards that are expected to vest and should be adjusted to reflect those awards

that ultimately vest.

The updated guidance is effective for annual and interim periods beginning after December 15,

2015, with early adoption permitted. The adoption of this guidance is not expected to have a material

effect on the Company’s results of operations, financial position or liquidity.

169