Travelers 2015 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2015 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company actively monitors and evaluates changes in third-party models and, when necessary,

calibrates the catastrophe risk model estimates delivered via its own proprietary modeling processes.

The Company considers historical loss experience, recent events, underwriting practices, market share

analyses, external scientific analysis and various other factors to account for non-modeled losses to

refine its proprietary view of catastrophe risk. These proprietary models are continually updated as new

information emerges.

The tables below set forth the probabilities that estimated losses, comprising claims and allocated

claim adjustment expenses (but excluding unallocated claim adjustment expenses), from a single event

occurring in a one-year timeframe will equal or exceed the indicated loss amounts (expressed in dollars

and as a percentage of the Company’s common equity), based on the current version of the proprietary

and third-party computer models utilized by the Company at December 31, 2015. For example, on the

basis described below the tables, the Company estimates that there is a one percent chance that the

Company’s loss from a single U.S. hurricane in a one-year timeframe would equal or exceed

$1.2 billion, or 5% of the Company’s common equity at December 31, 2015.

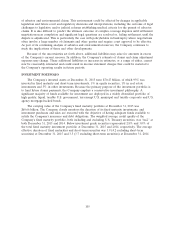

Dollars (in billions)

Single U.S.

Single U.S. and Canadian

Likelihood of Exceedance(1) Hurricane Earthquake

2.0% (1-in-50) ................................. $1.0 $0.5

1.0% (1-in-100) ................................. $1.2 $0.6

0.4% (1-in-250) ................................. $1.8 $0.9

0.1% (1-in-1,000) ............................... $3.4 $1.5

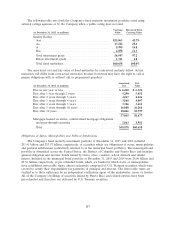

Percentage of

Common Equity(2)

Single U.S.

Single U.S. and Canadian

Likelihood of Exceedance Hurricane Earthquake

2.0% (1-in-50) ................................. 4% 2%

1.0% (1-in-100) ................................. 5% 3%

0.4% (1-in-250) ................................. 8% 4%

0.1% (1-in-1,000) ............................... 15% 7%

(1) An event that has, for example, a 2% likelihood of exceedance is sometimes described as

a ‘‘1-in-50 year event.’’ As noted above, however, the probabilities in the table represent

the likelihood of losses from a single event equaling or exceeding the indicated threshold

loss amount in a one-year timeframe, not over a multi-year timeframe. Also, because the

probabilities relate to a single event, the probabilities do not address the likelihood of

more than one event occurring in a particular period, and, therefore, the amounts do not

address potential aggregate catastrophe losses occurring in a one-year timeframe.

(2) The percentage of common equity is calculated by dividing (a) indicated loss amounts in

dollars by (b) total common equity excluding net unrealized investment gains and losses,

net of taxes. Net unrealized investment gains and losses can be significantly impacted by

both discretionary and other economic factors and are not necessarily indicative of

operating trends. Accordingly, the Company’s management uses the percentage of

common equity calculated on this basis as a metric to evaluate the potential impact of a

single hurricane or single earthquake on the Company’s financial position for purposes of

making underwriting and reinsurance decisions.

The threshold loss amounts in the tables above, which are based on the Company’s in-force

portfolio at December 31, 2015 and catastrophe reinsurance program at January 1, 2016, are net of

reinsurance, after-tax and exclude unallocated claim adjustment expenses, which historically have been

114