Travelers 2015 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2015 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.from credit losses as those losses are initially allocated to subordinated bondholders. The Company’s

investment strategy is to purchase CMO tranches that are expected to offer the most favorable return

given the Company’s assessment of associated risks. The Company does not purchase residual interests

in CMOs. For more information regarding the Company’s investments in residential mortgage-backed

securities, see note 3 of notes to the consolidated financial statements herein.

Alternative Documentation Mortgages and Sub-Prime Mortgages

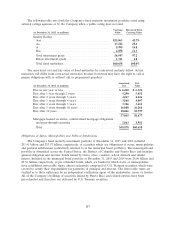

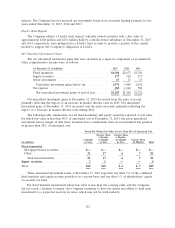

At December 31, 2015 and 2014, the Company’s fixed maturity investment portfolio included

CMOs backed by alternative documentation mortgages and asset-backed securities collateralized by

sub-prime mortgages with a collective fair value of $185 million and $252 million, respectively

(comprising less than 1% of the Company’s total fixed maturity investments at both dates). The

Company defines sub-prime mortgage-backed securities as investments in which the underlying loans

primarily exhibit one or more of the following characteristics: low FICO scores, above-prime interest

rates, high loan-to-value ratios or high debt-to-income ratios. Alternative documentation securitizations

are those in which the underlying loans primarily meet the government-sponsored entities’ requirements

for credit score but do not meet the government-sponsored entities’ guidelines for documentation,

property type, debt and loan-to-value ratios. The average credit rating on these securities and

obligations held by the Company was’’Ba2’’ at both December 31, 2015 and 2014. The Company does

not believe this portfolio exposes it to a material adverse impact on its results of operations, financial

position or liquidity, due to the portfolio’s relatively small size.

Commercial Mortgage-Backed Securities and Project Loans

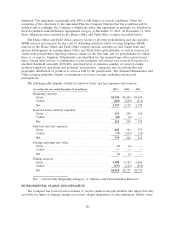

At December 31, 2015 and 2014, the Company held commercial mortgage-backed securities

(including FHA project loans) of $865 million and $715 million, respectively. The Company does not

believe this portfolio exposes it to a material adverse impact on its results of operations, financial

position or liquidity, due to the portfolio’s relatively small size and the underlying credit strength of

these securities. For more information regarding the Company’s investments in commercial mortgage-

backed securities, see note 3 of notes to the consolidated financial statements herein.

Equity Securities Available for Sale, Real Estate and Short-Term Investments

See note 1 of notes to the consolidated financial statements herein for further information about

these invested asset classes.

Other Investments

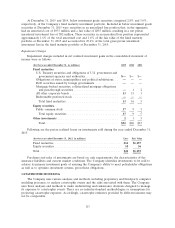

The Company also invests in private equity limited partnerships, hedge funds, and real estate

partnerships. Also included in other investments are non-public common and preferred equities and

derivatives. These asset classes have historically provided a higher return than fixed maturities but are

subject to more volatility. At December 31, 2015 and 2014, the carrying value of the Company’s other

investments was $3.45 billion and $3.59 billion, respectively.

Securities Lending

The Company has engaged in securities lending activities from which it generates net investment

income by lending certain of its investments to other institutions for short periods of time. At

December 31, 2015 and 2014, the Company had $269 million and $296 million of securities on loan,

respectively, as part of a tri-party lending agreement. The average monthly balance of securities on loan

during 2015 and 2014 was $268 million and $228 million, respectively. Borrowers of these securities

provide collateral equal to at least 102% of the market value of the loaned securities plus accrued

111