Travelers 2015 Annual Report Download - page 84

Download and view the complete annual report

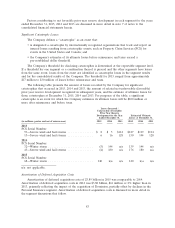

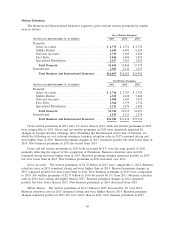

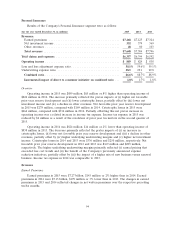

Please find page 84 of the 2015 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.General and Administrative Expenses

General and administrative expenses in 2015 were $4.08 billion, $127 million or 3% higher than in

2014. The increase primarily reflected the impact of a $76 million first quarter 2014 reduction in the

estimated liability for state assessments related to workers’ compensation premiums. General and

administrative expenses in 2014 were $3.95 billion, $195 million or 5% higher than in 2013. The

increase primarily reflected the impact of the acquisition of Dominion and increases in employee and

technology related expenses, partially offset by a reduction in the estimated liability for state

assessments primarily related to workers’ compensation premiums. General and administrative expenses

are discussed in more detail in the segment discussions that follow.

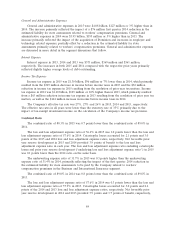

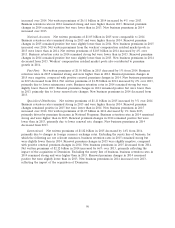

Interest Expense

Interest expense in 2015, 2014 and 2013 was $373 million, $369 million and $361 million,

respectively. The increases in both 2015 and 2014 compared with the respective prior years primarily

reflected slightly higher average levels of debt outstanding.

Income Tax Expense

Income tax expense in 2015 was $1.30 billion, $96 million or 7% lower than in 2014, which primarily

resulted from the $349 million decrease in income before income taxes in 2015 and the $32 million

reduction in income tax expense in 2015 resulting from the resolution of prior year tax matters. Income

tax expense in 2014 was $1.40 billion, $125 million or 10% higher than in 2013, which primarily resulted

from a $63 million reduction in income tax expense in 2013 resulting from the resolution of prior year tax

matters, as well as the $144 million increase in income before income taxes in 2014.

The Company’s effective tax rate was 27%, 27% and 26% in 2015, 2014 and 2013, respectively.

The effective tax rates in all years were lower than the statutory rate of 35% primarily due to the

impact of tax-exempt investment income on the calculation of the Company’s income tax provision.

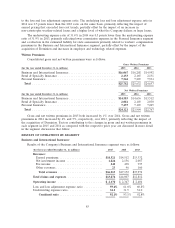

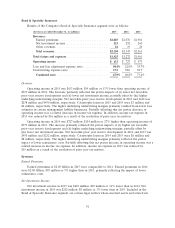

Combined Ratio

The combined ratio of 88.3% in 2015 was 0.7 points lower than the combined ratio of 89.0% in

2014.

The loss and loss adjustment expense ratio of 56.6% in 2015 was 1.0 points lower than the loss and

loss adjustment expense ratio of 57.6% in 2014. Catastrophe losses accounted for 2.1 points and 3.0

points of the 2015 and 2014 loss and loss adjustment expense ratios, respectively. Net favorable prior

year reserve development in 2015 and 2014 provided 3.9 points of benefit to the loss and loss

adjustment expense ratio in each year. The loss and loss adjustment expense ratio excluding catastrophe

losses and prior year reserve development (‘‘underlying loss and loss adjustment expense ratio’’) in 2015

was 0.1 points lower than the 2014 ratio on the same basis.

The underwriting expense ratio of 31.7% in 2015 was 0.3 points higher than the underwriting

expense ratio of 31.4% in 2014, primarily reflecting the impact of the first quarter 2014 reduction in

the estimated liability for state assessments to be paid by the Company related to workers’

compensation premiums in the Business and International Insurance segment.

The combined ratio of 89.0% in 2014 was 0.8 points lower than the combined ratio of 89.8% in

2013.

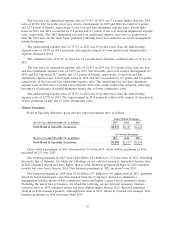

The loss and loss adjustment expense ratio of 57.6% in 2014 was 0.3 points lower than the loss and

loss adjustment expense ratio of 57.9% in 2013. Catastrophe losses accounted for 3.0 points and 2.6

points of the 2014 and 2013 loss and loss adjustment expense ratios, respectively. Net favorable prior

year reserve development in 2014 and 2013 provided 3.9 points and 3.7 points of benefit, respectively,

84