Travelers 2015 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2015 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

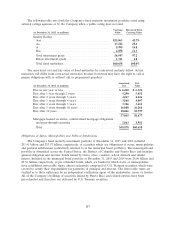

The $376 million decline in net reinsurance recoverables from December 31, 2014 primarily

reflected the impact of cash collections in 2015.

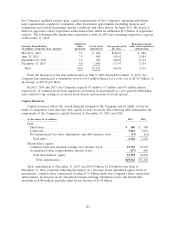

The following table presents the Company’s top five reinsurer groups by reinsurance recoverable at

December 31, 2015 (in millions). Also included is the A.M. Best rating of each reinsurer group at

February 11, 2016:

Reinsurance

Reinsurer Group Recoverable A.M. Best Rating of Group’s Predominant Reinsurer

Swiss Re Group ...................... $453 A+ second highest of 16 ratings

Munich Re Group .................... 418 A+ second highest of 16 ratings

Sompo Japan Nipponkoa Group .......... 232 A+ second highest of 16 ratings

Berkshire Hathaway ................... 229 A++ highest of 16 ratings

XL Capital Group .................... 196 A third highest of 16 ratings

At December 31, 2015, the Company held $1.10 billion of collateral in the form of letters of credit,

funds and trust agreements held to fully or partially collateralize certain reinsurance recoverables.

For a discussion of a pending reinsurance dispute pertaining to a portion of the Company’s

reinsurance recoverable from the Munich Re Group in the foregoing table, see note 16 of notes to the

consolidated financial statements herein.

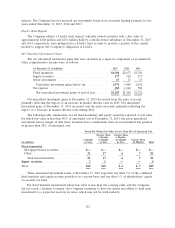

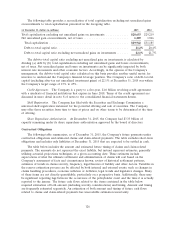

Included in reinsurance recoverables are amounts related to structured settlements, which are

annuities purchased from various life insurance companies to settle certain personal physical injury

claims, of which workers’ compensation claims comprise a significant portion. In cases where the

Company did not receive a release from the claimant, the amount due from the life insurance company

related to the structured settlement is included in the Company’s consolidated balance sheet as a

reinsurance recoverable and the related claim cost is included in the liability for claims and claim

adjustment expense reserves, as the Company retains the contingent liability to the claimant. If it is

expected that the life insurance company is not able to pay, the Company would recognize an

impairment of the related reinsurance recoverable if, and to the extent, the purchased annuities are not

covered by state guaranty associations. In the event that the life insurance company fails to make the

required annuity payments, the Company would be required to make such payments. The following

table presents the Company’s top five groups by structured settlements at December 31, 2015

(in millions). Also included is the A.M. Best rating of the Company’s predominant insurer from each

insurer group at February 11, 2016:

Structured

Group Settlements A.M. Best Rating of Group’s Predominant Insurer

Fidelity & Guaranty Life Group(1) .......... $910 B++ fifth highest of 16 ratings

MetLife Group(2) ...................... 408 A+ second highest of 16 ratings

Genworth Financial Group ................ 400 B++ fifth highest of 16 ratings

John Hancock Group .................... 321 A+ second highest of 16 ratings

Symetra Financial Corporation(3) ........... 226 A third highest of 16 ratings

(1) Fidelity & Guaranty Life (FGL) has entered into a definitive merger agreement with Anbang

Insurance Group Co., Ltd. whereby Anbang will acquire all of the outstanding shares of FGL. The

transaction is expected to close in the second quarter of 2016. A.M. Best’s ratings of FGL were

placed under review with developing implications following the announcement of the merger

agreement. The Company does not have any structured settlements with Anbang.

(2) MetLife Inc. has announced a plan to pursue the separation of a substantial portion of its U.S.

Retail segment. MetLife is currently evaluating structural alternatives for such a separation,

including a public offering of shares in an independent, publicly-traded company, a spin-off, or a

117