Travelers 2015 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2015 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

settlement and defense costs related to a broad number of policyholders in the Home Office category

due to a higher level of litigation activity surrounding mesothelioma claims than previously anticipated.

In addition, the reserve increase in 2013 also reflected higher projected payments on assumed

reinsurance accounts. The increase in the estimate of projected settlement and defense costs resulted

from payment trends that continue to be higher than previously anticipated due to the impact of the

current litigation environment discussed above. Notwithstanding these trends, the Company’s overall

view of the underlying asbestos environment is essentially unchanged from recent periods and there

remains a high degree of uncertainty with respect to future exposure to asbestos claims.

Net asbestos paid loss and loss expenses in 2015, 2014 and 2013 were $770 million, $242 million

and $218 million, respectively. Net payments in 2015 included the payment of the $502 million

settlement amounts related to the Settlement of Asbestos Direct Action Litigation as described in more

detail in note 16 of notes to the consolidated financial statements herein. Approximately 69%, 8% and

1% of total net paid losses in 2015, 2014 and 2013, respectively, related to policyholders with whom the

Company had entered into settlement agreements limiting the Company’s liability.

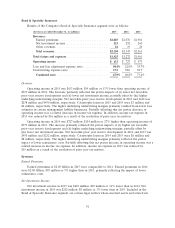

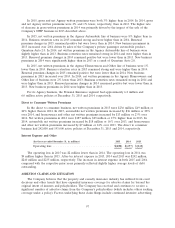

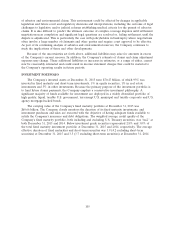

The Company categorizes its asbestos reserves as follows:

Number of Net Asbestos

Policyholders Total Net Paid Reserves

(at and for the year ended December 31, $ in millions) 2015 2014 2015 2014 2015 2014

Policyholders with settlement agreements .......... 18 17 $532 $19 $ 554 $ 613

Home office and field office .................... 1,624 1,692 220 197 1,101 1,574

Assumed reinsurance and other ................. ——18 26 155 170

Total ................................... 1,642 1,709 $770 $242 $1,810 $2,357

The Policyholders with Settlement Agreements category includes structured settlements, coverage

in place arrangements and, with respect to TPC, Wellington accounts. Reserves are based on the

expected payout for each policyholder under the applicable agreement. Structured settlements are

arrangements under which policyholders and/or plaintiffs agree to fixed financial amounts to be paid at

scheduled times. Coverage in place arrangements represent agreements with policyholders on specified

amounts of coverage to be provided. Payment obligations may be subject to annual maximums and are

only made when valid claims are presented. Wellington accounts refer to the 35 defendants that are

parties to a 1985 agreement settling certain disputes concerning insurance coverage for their asbestos

claims. Many of the aspects of the Wellington agreement are similar to those of coverage in place

arrangements in which the parties have agreed on specific amounts of coverage and the terms under

which the coverage can be accessed. As discussed above, in 2015 the Company paid a $502 million

settlement related to the asbestos direct action litigation. That amount had been included in the

Policyholders with Settlement Agreements category in the foregoing table at December 31, 2014.

On January 29, 2009, the Company and PPG Industries, Inc (‘‘PPG’’), along with approximately 30

other insurers of PPG, agreed in principle to an agreement to settle asbestos-related coverage litigation

under insurance policies issued to PPG. The tentative settlement agreement has been incorporated into

the Modified Third Amended Plan of Reorganization (‘‘Amended Plan’’) proposed as part of the

Pittsburgh Corning Corp. (‘‘PCC,’’ which is 50% owned by PPG) bankruptcy proceeding. Pursuant to

the proposed Amended Plan, which was filed on January 30, 2009, PCC, along with enumerated other

companies (including PPG as well as the Company as a participating insurer), are to receive protections

afforded by Section 524(g) of the Bankruptcy Code from certain asbestos-related bodily injury claims.

Under the agreement in principle, the Company has the option to make a series of payments over

20 years totaling approximately $620 million to the Trust to be created under the Amended Plan, or it

may elect to make a one-time discounted payment, which, as of June 30, 2016, would total

approximately $525 million. On January 7, 2016, the final objections to the Amended Plan were

100