Travelers 2015 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2015 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Debt Transactions.

2015. On August 25, 2015, the Company issued $400 million aggregate principal amount of 4.30%

senior notes that will mature on August 25, 2045. The net proceeds of the issuance, after original

issuance discount and the deduction of underwriting expenses and commissions and other expenses,

totaled approximately $392 million. Interest on the senior notes is payable semi-annually in arrears on

February 25 and August 25, commencing on February 25, 2016. Prior to February 25, 2045, the senior

notes may be redeemed, in whole or in part, at the Company’s option, at any time or from time to

time, at a redemption price equal to the greater of (a) 100% of the principal amount of any senior

notes to be redeemed or (b) the sum of the present values of the remaining scheduled payments of

principal and interest on any senior notes to be redeemed (exclusive of interest accrued to the date of

redemption) discounted to the date of redemption on a semi-annual basis (assuming a 360-day year

consisting of twelve 30-day months) at the then current rate of a treasury security having a maturity

comparable to the remaining term of these senior notes, plus 25 basis points. On or after February 25,

2045, the senior notes may be redeemed, in whole or in part, at the Company’s option, at any time or

from time to time, at a redemption price equal to 100% of the principal amount of any senior notes to

be redeemed.

On December 1, 2015, the Company’s $400 million, 5.50% senior notes matured and were fully

paid.

2013. On July 25, 2013, the Company issued $500 million aggregate principal amount of 4.60%

senior notes that will mature on August 1, 2043. The net proceeds of the issuance, after original

issuance discount and the deduction of underwriting expenses and commissions and other expenses,

totaled approximately $494 million. Interest on the senior notes is payable semi-annually in arrears on

February 1 and August 1. The senior notes are redeemable in whole at any time or in part from time

to time, at the Company’s option, at a redemption price equal to the greater of (a) 100% of the

principal amount of senior notes to be redeemed or (b) the sum of the present value of the remaining

scheduled payments of principal and interest on the senior notes to be redeemed (exclusive of interest

accrued to the date of redemption) discounted to the date of redemption on a semi-annual basis

(assuming a 360-day year consisting of twelve 30-day months) at the then current treasury rate (as

defined) plus 15 basis points.

On March 15, 2013, the Company’s $500 million, 5.00% senior notes matured and were fully paid.

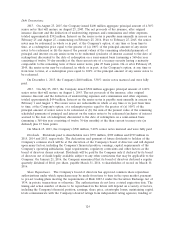

Dividends. Dividends paid to shareholders were $739 million, $729 million and $729 million in

2015, 2014 and 2013, respectively. The declaration and payment of future dividends to holders of the

Company’s common stock will be at the discretion of the Company’s board of directors and will depend

upon many factors, including the Company’s financial position, earnings, capital requirements of the

Company’s operating subsidiaries, legal requirements, regulatory constraints and other factors as the

board of directors deems relevant. Dividends will be paid by the Company only if declared by its board

of directors out of funds legally available, subject to any other restrictions that may be applicable to the

Company. On January 21, 2016, the Company announced that its board of directors declared a regular

quarterly dividend of $0.61 per share, payable March 31, 2016, to shareholders of record on March 10,

2016.

Share Repurchases. The Company’s board of directors has approved common share repurchase

authorizations under which repurchases may be made from time to time in the open market, pursuant

to pre-set trading plans meeting the requirements of Rule 10b5-1 under the Securities Exchange Act of

1934, in private transactions or otherwise. The authorizations do not have a stated expiration date. The

timing and actual number of shares to be repurchased in the future will depend on a variety of factors,

including the Company’s financial position, earnings, share price, catastrophe losses, maintaining capital

levels commensurate with the Company’s desired ratings from independent rating agencies, funding of

124