Travelers 2015 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2015 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287

|

|

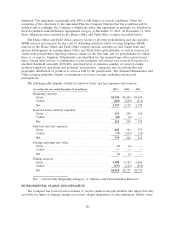

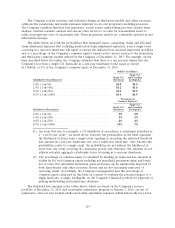

of asbestos and environmental claims. This environment could be affected by changes in applicable

legislation and future court and regulatory decisions and interpretations, including the outcome of legal

challenges to legislative and/or judicial reforms establishing medical criteria for the pursuit of asbestos

claims. It is also difficult to predict the ultimate outcome of complex coverage disputes until settlement

negotiations near completion and significant legal questions are resolved or, failing settlement, until the

dispute is adjudicated. This is particularly the case with policyholders in bankruptcy where negotiations

often involve a large number of claimants and other parties and require court approval to be effective.

As part of its continuing analysis of asbestos and environmental reserves, the Company continues to

study the implications of these and other developments.

Because of the uncertainties set forth above, additional liabilities may arise for amounts in excess

of the Company’s current reserves. In addition, the Company’s estimate of claims and claim adjustment

expenses may change. These additional liabilities or increases in estimates, or a range of either, cannot

now be reasonably estimated and could result in income statement charges that could be material to

the Company’s operating results in future periods.

INVESTMENT PORTFOLIO

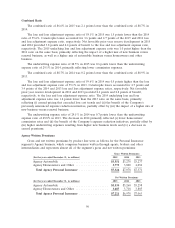

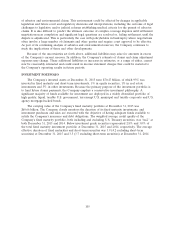

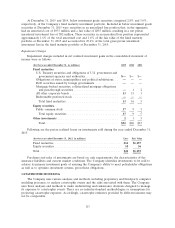

The Company’s invested assets at December 31, 2015 were $70.47 billion, of which 93% was

invested in fixed maturity and short-term investments, 1% in equity securities, 1% in real estate

investments and 5% in other investments. Because the primary purpose of the investment portfolio is

to fund future claims payments, the Company employs a conservative investment philosophy. A

significant majority of funds available for investment are deployed in a widely diversified portfolio of

high quality, liquid, taxable U.S. government, tax-exempt U.S. municipal and taxable corporate and U.S.

agency mortgage-backed bonds.

The carrying value of the Company’s fixed maturity portfolio at December 31, 2015 was

$60.66 billion. The Company closely monitors the duration of its fixed maturity investments, and

investment purchases and sales are executed with the objective of having adequate funds available to

satisfy the Company’s insurance and debt obligations. The weighted average credit quality of the

Company’s fixed maturity portfolio, both including and excluding U.S. Treasury securities, was ‘‘Aa2’’ at

both December 31, 2015 and 2014. Below investment grade securities represented 2.8% and 3.0% of

the total fixed maturity investment portfolio at December 31, 2015 and 2014, respectively. The average

effective duration of fixed maturities and short-term securities was 3.9 (4.2 excluding short-term

securities) at December 31, 2015 and 3.5 (3.7 excluding short-term securities) at December 31, 2014.

105