Travelers 2015 Annual Report Download - page 237

Download and view the complete annual report

Please find page 237 of the 2015 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

14. PENSION PLANS, RETIREMENT BENEFITS AND SAVINGS PLANS (Continued)

considered the historical returns of equity and fixed maturity markets in conjunction with prevailing

economic and financial market conditions.

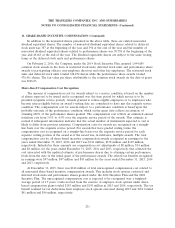

As an indicator of sensitivity, increasing the assumed health care cost trend rate by 1% would have

increased the accumulated postretirement benefit obligation by $25 million at December 31, 2015, and

the aggregate of the service and interest cost components of net postretirement benefit expense by

$1 million for the year ended December 31, 2015. Decreasing the assumed health care cost trend rate

by 1% would have decreased the accumulated postretirement benefit obligation at December 31, 2015

by $21 million and the aggregate of the service and interest cost components of net postretirement

benefit expense by $1 million for the year ended December 31, 2015.

The assumptions made for the Company’s foreign pension and foreign postretirement benefit plans

are not materially different from those of the Company’s qualified domestic pension plan and the

domestic postretirement benefit plan.

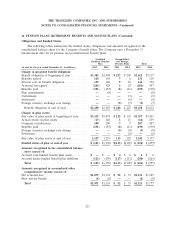

Plan Assets

The qualified domestic pension plan assets are invested for the exclusive benefit of the plan

participants and beneficiaries and are intended, over time, to satisfy the benefit obligations under the

plan. Risk tolerance is established through consideration of plan liabilities, plan funded status and

corporate financial position. The asset mix guidelines have been established and are reviewed quarterly.

These guidelines are intended to serve as tools to facilitate the investment of plan assets to maximize

long-term total return and the ongoing oversight of the plan’s investment performance. Investment risk

is measured and monitored on an ongoing basis through daily and monthly investment portfolio

reviews, annual liability measurements and periodic asset/liability studies.

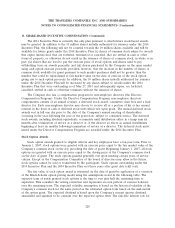

The Company’s overall investment strategy for the qualified domestic pension plan is to achieve a

mix of approximately 85% to 90% of investments for long-term growth and 10% to 15% for near-term

benefit payments with a diversification of asset types, fund strategies and fund managers. The current

target allocations for plan assets are 55% to 65% equity securities and 20% to 40% fixed income

securities, with the remainder allocated to short-term securities. Equity securities primarily include

investments in large, medium and small-cap companies primarily located in the United States. Fixed

income securities include corporate bonds of companies from diversified industries, mortgage-backed

securities, U.S. Treasury securities and debt securities issued by foreign governments. Other investments

include two private equity funds held by the Company’s qualified defined benefit pension plan. One

private equity fund is focused on financial companies, and the other is focused on real estate-related

investments.

Assets of the Company’s foreign pension plans are not significant.

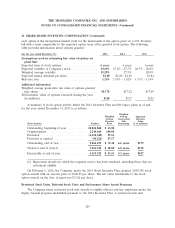

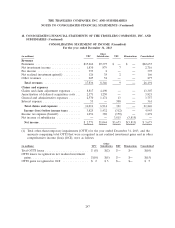

Fair Value Measurement—Pension Plans and Other Postretirement Benefit Assets

For a discussion of the methods employed by the Company to measure the fair value of invested

assets, see note 4. The following discussion of fair value measurements applies exclusively to the

Company’s pension plans and other postretirement benefit assets.

Fair value estimates for equity and bond mutual funds held by the pension plans reflect prices

received from an external pricing service that are based on observable market transactions. These

estimates are included in Level 1.

237