Travelers 2015 Annual Report Download - page 130

Download and view the complete annual report

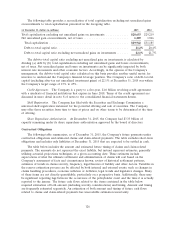

Please find page 130 of the 2015 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Connecticut Insurance Department. The Company may choose to accelerate the timing within 2016

and/or increase the amount of dividends from its insurance subsidiaries in 2016, which could result in

certain dividends being subject to approval by the Connecticut Insurance Department.

In addition to the regulatory restrictions on the availability of dividends that can be paid by the

Company’s U.S. insurance subsidiaries, the maximum amount of dividends that may be paid to the

Company’s shareholders is limited, to a lesser degree, by certain covenants contained in its line of

credit agreement with a syndicate of financial institutions that require the Company to maintain a

minimum consolidated net worth as described in note 8 of notes to the consolidated financial

statements herein.

TRV is not dependent on dividends or other forms of repatriation from its foreign operations to

support its liquidity needs. The undistributed earnings of the Company’s foreign operations are not

material and are intended to be permanently reinvested in those operations.

TRV and its two non-insurance holding company subsidiaries received dividends of $3.75 billion,

$4.10 billion and $2.90 billion from their U.S. insurance subsidiaries in 2015, 2014 and 2013,

respectively.

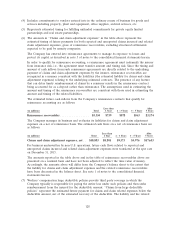

Pension and Other Postretirement Benefit Plans

The Company sponsors a qualified non-contributory defined benefit pension plan (the Qualified

Plan), which covers substantially all U.S. domestic employees and provides benefits primarily under a

cash balance formula. In addition, the Company sponsors a nonqualified defined benefit pension plan

which covers certain highly-compensated employees, pension plans for employees of its foreign

subsidiaries, and a postretirement health and life insurance benefit plan for employees satisfying certain

age and service requirements and for certain retirees.

The Qualified Plan is subject to regulations under the Employee Retirement Income Act of 1974

as amended (ERISA), which requires plans to meet minimum standards of funding and requires such

plans to subscribe to plan termination insurance through the Pension Benefit Guaranty Corporation

(PBGC). The Company does not have a minimum funding requirement for the Qualified Plan for 2016

and does not anticipate having a minimum funding requirement in 2017. The Company has significant

discretion in making contributions above those necessary to satisfy the minimum funding requirements.

In 2015, 2014 and 2013, there was no minimum funding requirement for the Qualified Plan. In 2015

and 2014, the Company voluntarily made contributions totaling $100 million and $200 million,

respectively, to the Qualified Plan. In determining future contributions, the Company will consider the

performance of the plan’s investment portfolio, the effects of interest rates on the projected benefit

obligation of the plan and the Company’s other capital requirements. The Company has not

determined whether or not additional voluntary funding will be made in 2016. However, the Company

currently believes, subject to actual plan performance and funded status at the time, that it may make

voluntary pension contributions of approximately $75 million to $100 million annually beginning in

2016.

Beginning in 2016, the Company will use a full yield-curve approach in the estimation of the

service and interest cost components of net periodic benefit costs for its qualified and nonqualified

domestic pension plans and the domestic postretirement benefit plans. The full yield curve approach

applies the specific spot rates along the yield curve that are used in its determination of the projected

benefit obligation at the beginning of the year to the projected cash flows related to service and

interest costs. Historically, the Company estimated the service and interest cost components by applying

a single weighted-average discount rate derived from this yield curve. This change is being made to

better align the projected benefit cash flows and the corresponding yield curve spot rates to provide a

better estimate of service and interest cost components of net periodic benefit costs, consistent with the

methodology used to estimate the projected benefit obligation for each of the benefit plans.

130