Travelers 2015 Annual Report Download - page 191

Download and view the complete annual report

Please find page 191 of the 2015 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

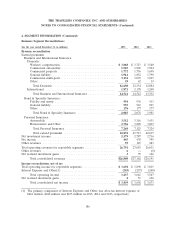

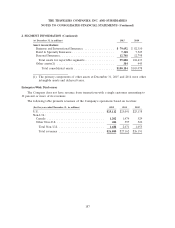

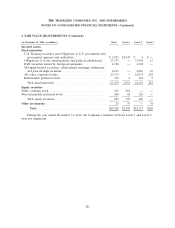

3. INVESTMENTS (Continued)

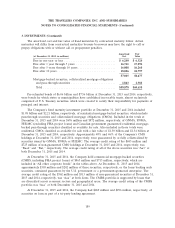

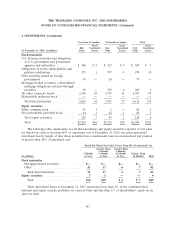

Proceeds from the sale of real estate investments were $31 million, $15 million and $18 million in

2015, 2014 and 2013, respectively. Gross gains of $4 million, $6 million and $7 million were realized on

those sales in 2015, 2014 and 2013, respectively, and there were no gross losses. The Company had no

real estate held for sale at December 31, 2015 and 2014. Accumulated depreciation on real estate held

for investment purposes was $320 million and $290 million at December 31, 2015 and 2014,

respectively.

Future minimum rental income on operating leases relating to the Company’s real estate

properties is expected to be $92 million, $74 million, $61 million, $49 million and $36 million for 2016,

2017, 2018, 2019 and 2020, respectively, and $59 million for 2021 and thereafter.

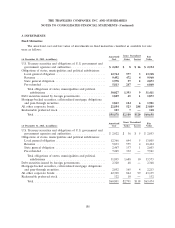

Short-term Securities

The Company’s short-term securities consist of Aaa-rated registered money market funds, U.S.

Treasury securities, high-quality commercial paper (primarily A1/P1) and high-quality corporate

securities purchased within a year to their maturity with a combined average of 67 days to maturity at

December 31, 2015. The amortized cost of these securities, which totaled $4.67 billion and $4.36 billion

at December 31, 2015 and 2014, respectively, approximated their fair value.

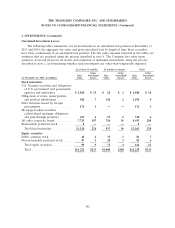

Variable Interest Entities

Entities which do not have sufficient equity at risk to allow the entity to finance its activities

without additional financial support or in which the equity investors, as a group, do not have the

characteristic of a controlling financial interest are referred to as variable interest entities (VIE). A

VIE is consolidated by the variable interest holder that is determined to have the controlling financial

interest (primary beneficiary) as a result of having both the power to direct the activities of a VIE that

most significantly impact the VIE’s economic performance and the obligation to absorb losses or right

to receive benefits from the VIE that could potentially be significant to the VIE. The Company

determines whether it is the primary beneficiary of an entity subject to consolidation based on a

qualitative assessment of the VIE’s capital structure, contractual terms, nature of the VIE’s operations

and purpose and the Company’s relative exposure to the related risks of the VIE on the date it

becomes initially involved in the VIE. The Company reassesses its VIE determination with respect to

an entity on an ongoing basis.

The Company is a passive investor in limited partner equity interests issued by third party VIEs.

These include certain of the Company’s investments in private equity limited partnerships, hedge funds

and real estate partnerships where the Company is not related to the general partner. These

investments are generally accounted for under the equity method and reported in the Company’s

consolidated balance sheet as other investments unless the Company is deemed the primary beneficiary.

These equity interests generally cannot be redeemed. Distributions from these investments are received

by the Company as a result of liquidation of the underlying investments of the funds and/or as income

distribution. The Company’s maximum exposure to loss with respect to these investments is limited to

the investment carrying amounts reported in the Company’s consolidated balance sheet and any

unfunded commitment. Neither the carrying amounts nor the unfunded commitments related to these

VIEs are material.

191