Travelers 2015 Annual Report Download - page 228

Download and view the complete annual report

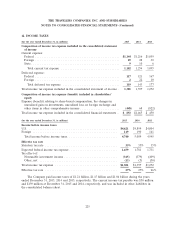

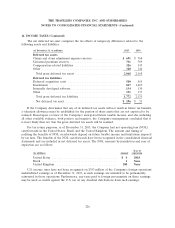

Please find page 228 of the 2015 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

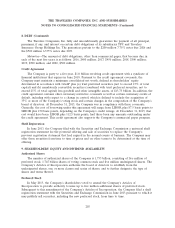

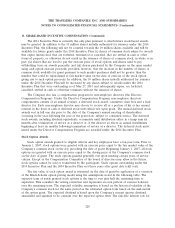

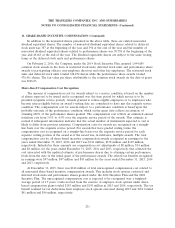

13. SHARE-BASED INCENTIVE COMPENSATION (Continued)

The 2014 Incentive Plan is currently the only plan pursuant to which future stock-based awards

may be granted. In addition to the 10 million shares initially authorized for issuance under the 2014

Incentive Plan, the following will not be counted towards the 10 million shares available and will be

available for future grants under the 2014 Incentive Plan: (i) shares of common stock subject to awards

that expire unexercised, that are forfeited, terminated or canceled, that are settled in cash or other

forms of property, or otherwise do not result in the issuance of shares of common stock, in whole or in

part; (ii) shares that are used to pay the exercise price of stock options and shares used to pay

withholding taxes on awards generally; and (iii) shares purchased by the Company on the open market

using cash option exercise proceeds; provided, however, that the increase in the number of shares of

common stock available for grant pursuant to such market purchases shall not be greater than the

number that could be repurchased at fair market value on the date of exercise of the stock option

giving rise to such option proceeds. In addition, the 10 million shares initially authorized for issuance

under the 2014 Incentive Plan will be increased by any shares subject to awards under the 2004

Incentive Plan that were outstanding as of May 27, 2014 and subsequently expire, are forfeited,

cancelled, settled in cash or otherwise terminate without the issuance of shares.

The Company also has a compensation program for non-employee directors (the Director

Compensation Program). Under the Director Compensation Program, non-employee directors’

compensation consists of an annual retainer, a deferred stock award, committee chair fees and a lead

director fee. Each non-employee director may choose to receive all or a portion of his or her annual

retainer in the form of cash or deferred stock units which vest upon grant. The annual deferred stock

awards vest in full one day prior to the date of the Company’s annual meeting of shareholders

occurring in the year following the year of the grant date, subject to continued service. The deferred

stock awards, including dividend equivalents, accumulate until distribution either in a lump sum six

months after termination of service as a director or, if the director so elects, in annual installments

beginning at least six months following termination of service as a director. The deferred stock units

issued under the Director Compensation Program are awarded under the 2014 Incentive Plan.

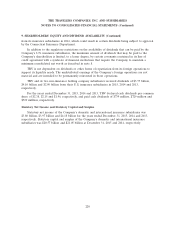

Stock Option Awards

Stock option awards granted to eligible officers and key employees have a ten-year term. Prior to

January 1, 2007, stock options were granted with an exercise price equal to the fair market value of the

Company’s common stock on the day preceding the date of grant. Beginning January 1, 2007, all stock

options are granted with an exercise price equal to the closing price of the Company’s common stock

on the date of grant. The stock options granted generally vest upon meeting certain years of service

criteria. Except as the Compensation Committee of the board of directors may allow in the future,

stock options cannot be sold or transferred by the participant. Stock options outstanding under the

2014 Incentive Plan and the 2004 Incentive Plan vest three years after grant date (cliff vest).

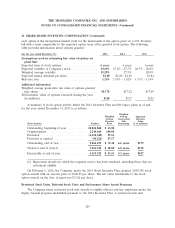

The fair value of each option award is estimated on the date of grant by application of a variation

of the Black-Scholes option pricing model using the assumptions noted in the following table. The

expected term of newly granted stock options is the time to vest plus half the remaining time to

expiration. This considers the vesting restriction and represents an even pattern of exercise behavior

over the remaining term. The expected volatility assumption is based on the historical volatility of the

Company’s common stock for the same period as the estimated option term based on the mid-month

of the option grant. The expected dividend is based upon the Company’s current quarter dividend

annualized and assumed to be constant over the expected option term. The risk-free interest rate for

228