Travelers 2015 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2015 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Operating Activities

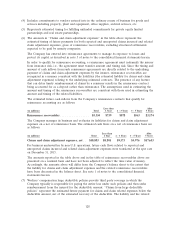

Net cash flows provided by operating activities were $3.43 billion, $3.69 billion and $3.82 billion in

2015, 2014 and 2013, respectively. Cash flows in 2015 reflected a higher level of losses and loss

adjustment expenses paid as a result of the Company’s $579 million payment related to the settlement

of the Asbestos Direct Action Litigation as described in more detail in note 16 of notes to the

consolidated financial statements herein and a lower level of net investment income, partially offset by

a higher level of collected premiums and a lower contribution to the Company’s qualified domestic

pension plan. Cash flows in 2014 primarily reflected higher levels of payments for claims and claim

adjustment expenses, general and administrative expenses and commission expenses, as well as higher

income tax payments, partially offset by higher levels of collected premiums. These increases included

the impact of the Company’s acquisition of Dominion. Cash flows in 2013 primarily reflected a

decrease in losses paid related to catastrophes and a higher level of collected premiums, partially offset

by an increase in income tax payments. In 2015 and 2014, the Company voluntarily made contributions

totaling $100 million and $200 million, respectively, to its qualified domestic pension plan. In 2013, the

Company made no contributions to its qualified domestic pension plan. The qualified domestic pension

plan was 96% funded at both December 31, 2015 and 2014.

Investing Activities

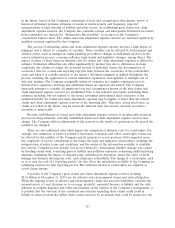

Net cash provided by investing activities was $317 million in 2015, compared with net cash flows

provided by investing activities of $206 million in 2014 and net cash flows used in investing activities of

$910 million in 2013. The 2013 total included $997 million related to the Company’s acquisition of

Dominion (net of cash acquired). The Company’s consolidated total investments at December 31, 2015

decreased by $2.79 billion, or 4% from year-end 2014, primarily reflecting a decrease in the unrealized

appreciation of investments, common share repurchases, the impact of changes in foreign currency

exchange rates and dividends paid to shareholders, partially offset by net cash flows provided by

operating activities. The Company’s consolidated total investments at December 31, 2014 increased by

$101 million, or less than 1% over year-end 2013, primarily reflecting the impact of net cash flows

provided by operating activities and an increase in net unrealized appreciation of investments, largely

offset by common share repurchases and dividends paid to shareholders.

The Company’s investment portfolio is managed to support its insurance operations; accordingly,

the portfolio is positioned to meet obligations to policyholders. As such, the primary goals of the

Company’s asset-liability management process are to satisfy the insurance liabilities and maintain

sufficient liquidity to cover fluctuations in projected liability cash flows. Generally, the expected

principal and interest payments produced by the Company’s fixed maturity portfolio adequately fund

the estimated runoff of the Company’s insurance reserves. Although this is not an exact cash flow

match in each period, the substantial amount by which the market value of the fixed maturity portfolio

exceeds the value of the net insurance liabilities, as well as the positive cash flow from newly sold

policies and the large amount of high quality liquid bonds, contributes to the Company’s ability to fund

claim payments without having to sell illiquid assets or access credit facilities.

Financing Activities

Net cash flows used in financing activities were $3.73 billion, $3.81 billion and $2.94 billion in 2015,

2014 and 2013, respectively. The totals in each year primarily reflected common share repurchases and

dividends to shareholders, partially offset by the proceeds from employee stock option exercises. The

total in 2015 also included the issuance of 4.30% senior notes for net proceeds of $392 million and the

payment of the Company’s $400 million, 5.50% senior notes at maturity. The total in 2013 also

included the issuance of 4.60% senior notes for net proceeds of $494 million and the payment of the

Company’s $500 million, 5.00% senior notes at maturity. Common share repurchases in 2015, 2014 and

2013 were $3.22 billion, $3.33 billion and $2.46 billion, respectively.

123