Travelers 2015 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2015 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.sale. A.M. Best’s ratings of MetLife Inc. and its subsidiaries were placed under review with

developing implications following the announcement of this plan.

(3) Symetra Financial Corporation became a wholly-owned subsidiary of Sumitomo Life Insurance

Company on February 1, 2016 upon the closing of a previously announced merger

agreement. A.M. Best’s ratings of Symetra were unchanged following the completion of the

merger. The Company does not have any structured settlements with Sumitomo Life.

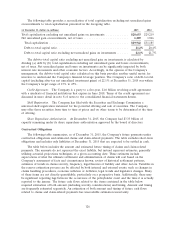

The Company considers the ratings and related outlook assigned to reinsurance companies and life

insurance companies by various independent ratings agencies in assessing the adequacy of its allowance

for uncollectible amounts.

OUTLOOK

The following discussion provides outlook information for certain key drivers of the Company’s

results of operations and capital position.

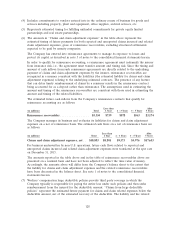

Premiums. The Company’s earned premiums are a function of net written premium volume. Net

written premiums comprise both renewal business and new business and are recognized as earned

premium over the life of the underlying policies. When business renews, the amount of net written

premiums associated with that business may increase or decrease (renewal premium change) as a result

of increases or decreases in rate and/or insured exposures, which the Company considers as a measure

of units of exposure (such as the number and value of vehicles or properties insured). Net written

premiums from both renewal and new business, and therefore earned premiums, are impacted by

competitive market conditions as well as general economic conditions, which, particularly in the case of

the Business and International Insurance segment, affect audit premium adjustments, policy

endorsements and mid-term cancellations. Property and casualty insurance market conditions are

expected to remain competitive. Net written premiums may also be impacted by the structure of

reinsurance programs and related costs, as well as changes in foreign currency exchange rates.

Overall, the Company expects retention levels (the amount of expiring premium that renews,

before the impact of renewal premium changes) will remain strong by historical standards. In the

Business and International Insurance segment, the Company expects that domestic renewal premium

changes during 2016 will remain positive but will be slightly lower than the levels attained in 2015.

Given the relatively smaller amount of premium that the Company generates from outside the United

States and the transactional nature of some of those markets, particularly Lloyd’s, international renewal

premium changes during 2016 could be somewhat higher, broadly consistent with or somewhat lower

than the levels attained in 2015. In the Bond & Specialty Insurance segment, the Company expects that

renewal premium changes with respect to management liability business during 2016 will remain

positive, but will be slightly lower than the levels attained in 2015. With respect to surety business,

within the Bond & Specialty Insurance segment, the Company expects that net written premium

volume during 2016 will be slightly higher than the levels attained in 2015. In the Personal Insurance

segment, the Company expects that Agency Auto renewal premium changes during 2016 will remain

positive and will be slightly higher than the levels attained in 2015, and Agency Homeowners and Other

renewal premium changes during 2016 will remain positive, but will be lower than the levels attained in

2015. The need for state regulatory approval for changes to personal property and casualty insurance

prices, as well as competitive market conditions, may impact the timing and extent of renewal premium

changes.

Property and casualty insurance market conditions are expected to remain competitive in 2016 for

new business, not only in Business and International Insurance and Bond & Specialty Insurance, but

especially in Personal Insurance, where price comparison technology used by agents and brokers,

sometimes referred to as ‘‘comparative raters,’’ has facilitated the process of generating multiple quotes,

thereby increasing price comparison on new business and, increasingly, on renewal business. The

Company expects that its Quantum Auto 2.0 product in the Personal Insurance segment’s Agency

118